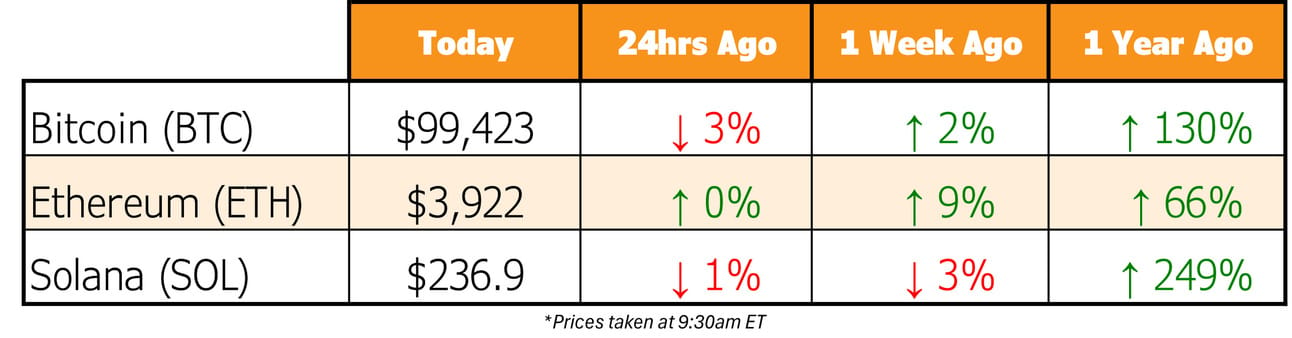

$100k Bitcoin Is Just The Beginning

Bitcoin Hits $100K! Altseason Heats Up and Our Smoking Chicken Fish Trade Wins Big

Hey hey Hodl Heroes,

Welcome to this week’s Hodl Report, where our insights are as fresh as Bitcoin making new all-time highs. 🚀

This week, we’re diving into:

Bitcoin hits $100k - where do we go from here? 🔮

Important news this week 🗞️

Portfolio updates & trade breakdowns 📊

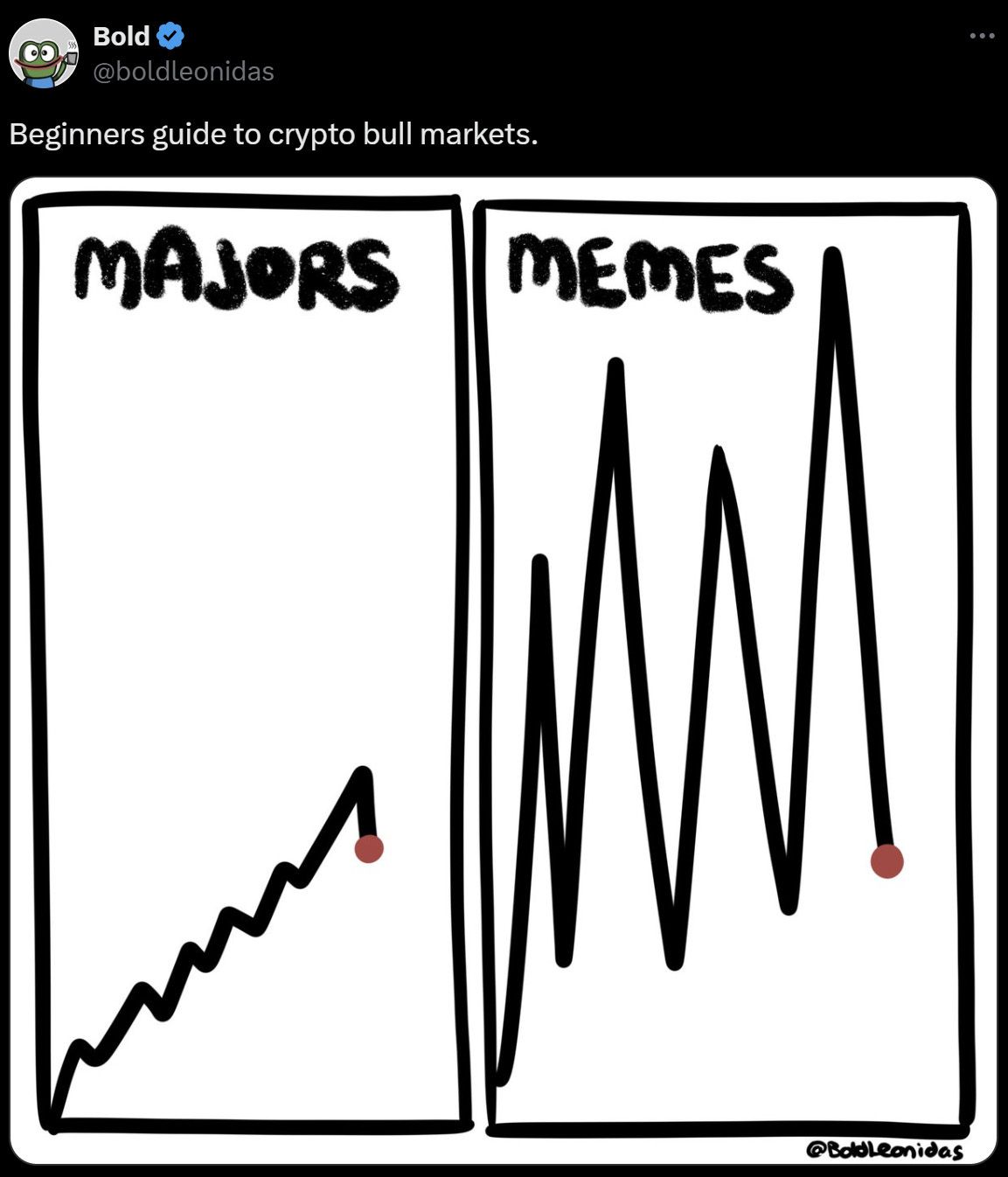

A sprinkle of crypto laughs 😂

Add a piece of the energy sector to your portfolio.

Access to 300 million barrels of recoverable oil reserves

Royalty-based investment model reducing operational risks

Projected 25+ years of potential royalty income

Not to toot our own horn, but…

Beep beep! 🚘

Our predictions are crushing it.

This week (ahead of schedule), Bitcoin cut through $100k like a hot knife slicing through digital butter. 🔪🧈

Months ago, we called $110k+ Bitcoin before the end of 2024 and we are well on our way.

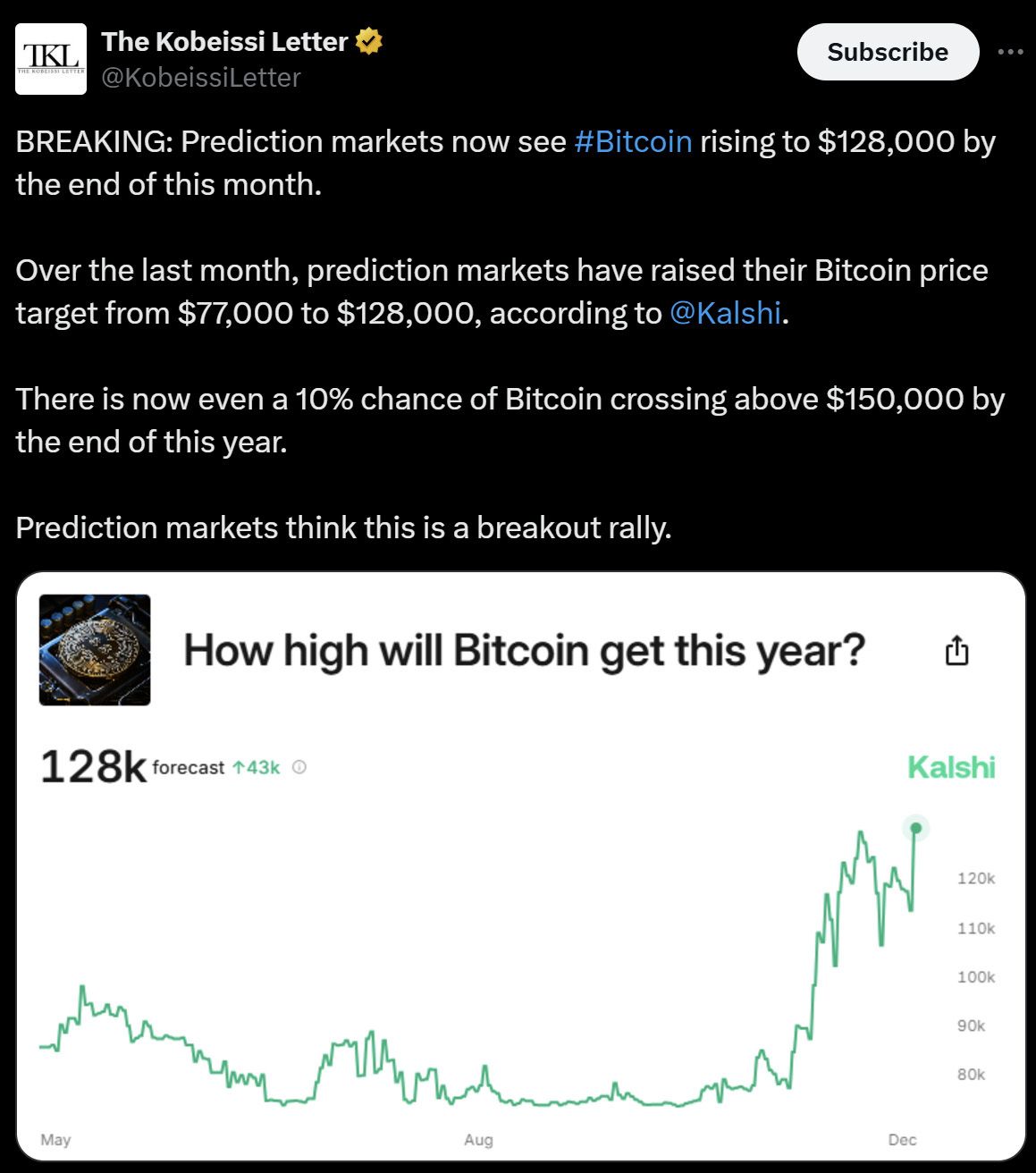

Seems like the prediction markets are finally catching up, but you, our savvy readers, have been ahead of the curve for months. 😉

While everyone’s popping champagne over Bitcoin hitting the $100k milestone, we’re over here asking what’s next?

Let’s break it down. 👇

$100k is Just the Start

Hitting $100k wasn’t just historic - it was inevitable. And of course, it happened at night, while the stock markets snoozed and Bitcoin ETFs took a break. 😴

What’s next? Four big catalysts are ready to send Bitcoin (and the whole crypto market) soaring in the months ahead:

1. Trump’s Crypto Dream Team

The incoming administration features crypto-friendly heavyweights like Scott Bessent (Treasury) and Paul Atkins (SEC Chair), poised to boost Bitcoin-friendly policies. Trump’s pro-crypto team includes:

JD Vance – Vice President

Scott Bessent – Treasury Secretary

Pete Hegseth – Secretary of Defense

Paul Atkins – SEC Chair

Howard Lutnick – Secretary of Commerce

RFK Jr. – Secretary of Health and Human Services

Elon Musk and Vivek Ramaswamy – Department of Government Efficiency (DOGE)

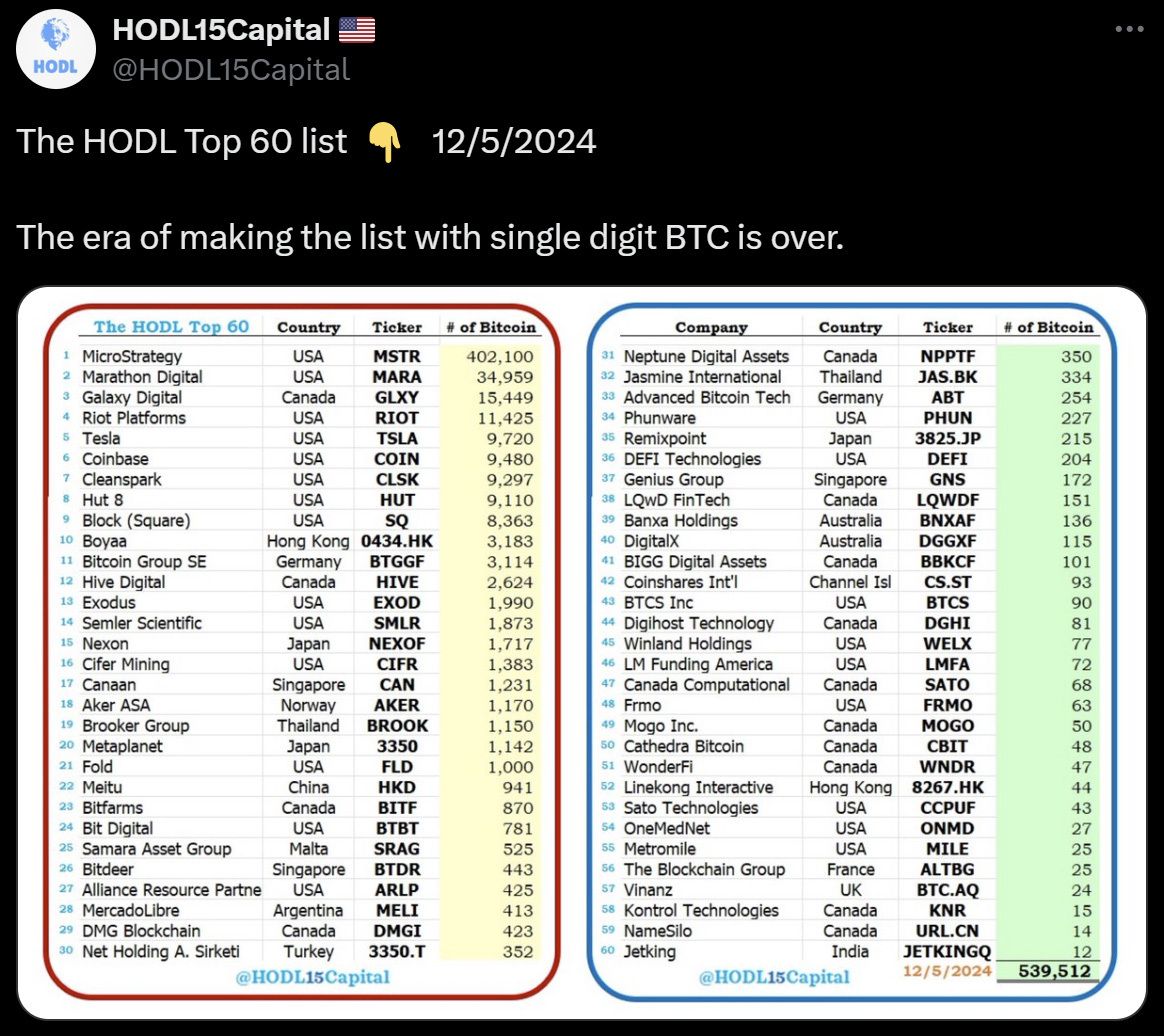

2. Institutional Moves

Corporate treasuries are beefing up, with heavyweights like MicroStrategy and Marathon Digital leading the charge. As more companies jump on the Bitcoin bandwagon, expect the momentum to snowball into something massive.

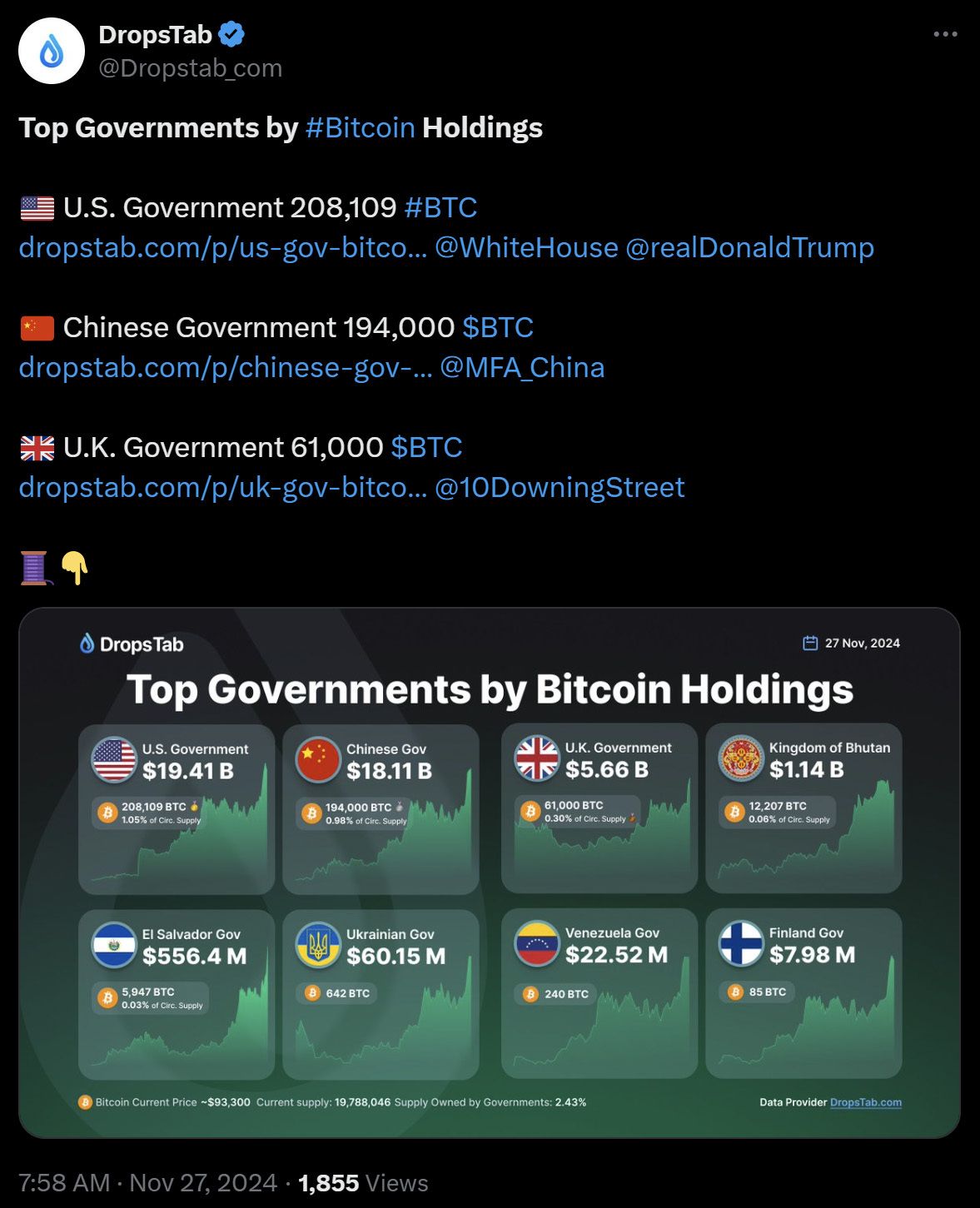

3. Nation-State Adoption

Bhutan and El Salvador are paving the way with dedicated Bitcoin reserves, but if the U.S. sets up a strategic reserve as is planned, it could kick off a global Bitcoin arms race. Many countries already hold Bitcoin they’ve confiscated from criminals. The big question - will they cash out or hodl it in their reserves?

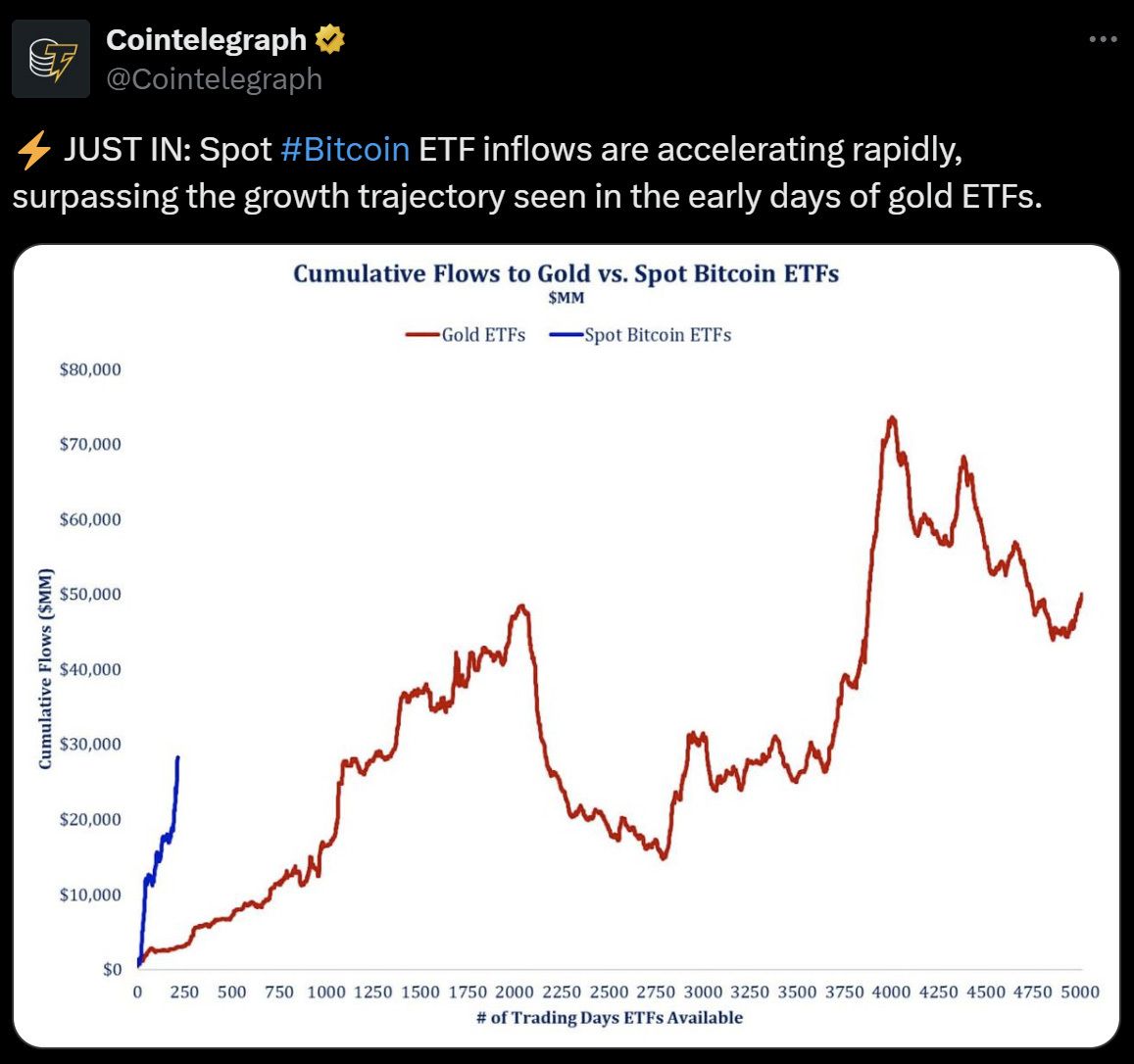

4. The New Digital Gold

Bitcoin ETFs are crushing it, blowing past the early success of gold ETFs. As the ultimate digital alternative to gold (we broke it down here: Bitcoin vs. Gold), expect Bitcoin’s $2T market cap to level up and start eating into gold’s $18T market share.

How much time is left in this bull run? Well, that depends - will history repeat itself and stay cyclical? Each cycle has its own vibe, but they’ve all followed a pattern so far. History might not repeat, but it sure loves to rhyme. 🎵

Let’s wrap it up with another bold prediction…

Bitcoin smashes $150k before this bull run is over.

Yep, we said it - and let’s be real, we’ll probably be ahead of schedule on this one too. 😉

New Decentraland desktop client for Mac and Windows

Enhanced avatars and social interactions

Improved performance and upgraded environments

New features: badges, daily quests, and mini-games

Hodl Headlines

The Week’s Most Interesting News

MicroStrategy Acquires Additional $1.5 Billion in Bitcoin: MicroStrategy has expanded its Bitcoin holdings by purchasing an additional $1.5 billion worth of the cryptocurrency. This move reinforces the company's commitment to Bitcoin as a primary treasury asset.

Grayscale Files for Spot Solana ETF with SEC: Grayscale Investments has filed with the SEC to launch a spot Solana ETF, aiming to provide investors with direct exposure to Solana. This move reflects growing institutional interest in diverse crypto assets.

WisdomTree Seeks Approval for Spot XRP ETF: Asset manager WisdomTree has filed for a spot XRP ETF, indicating a push to offer investors regulated access to XRP. This application comes amid increasing demand for crypto-based financial products.

Apple Pay Now Supports Cryptocurrency Purchases: Users can now utilize Apple Pay to buy cryptocurrencies, marking a significant integration of digital assets into mainstream payment systems. This development enhances the accessibility of crypto investments for everyday consumers.

Hawk Tuah Memecoin Plummets 90% After Launch: The recently launched $HAWK memecoin experienced a dramatic 90% drop in value, sparking outrage and allegations of insider trading. Despite denials from creator Hailey Welch, evidence suggests early access for insiders, leading to SEC reports.

Bitcoin Price Drops Amid South Korea's Martial Law Declaration: Bitcoin's price experienced a sharp decline to $65,000 on South Korean exchanges following the country's imposition of martial law. The political instability led to decreased liquidity and heightened market volatility.

DeFi Superapp Emerges as Competitor to Aave and Uniswap: A new decentralized finance superapp has entered the market, positioning itself as a formidable competitor to established platforms like Aave and Uniswap. This development could significantly reshape the DeFi landscape.

Federal Reserve Chair Powell Compares Bitcoin to Gold: Federal Reserve Chair Jerome Powell has drawn comparisons between Bitcoin and gold, acknowledging Bitcoin's role as a significant asset. This statement addstcoin's status in the financial ecosystem.

Bitcoin Millionaire Initiates $2M Treasure Hunt Across U.S.: Jon Collins-Black, a Bitcoin millionaire$2 million in treasures across the United States, providing clues through his book "There's Treasure Inside." The hunt includes valuable items like gold doubloons and rare artifacts, encouraging nationwide participation.

Michael Saylor Presents Bitcoin Treasury Strategy to Microsoft: MicroStrategy's Michael Saylor presented to Microsoft's board, suggesting that investing $100 billion annually in Bitcoin could add nearly $5 trillion to its market cap. He emphasized Bitcoin as the next significant technological wave. See Saylor’s presentation here.

Hodl Report Portfolio

😎 Altseason Is Here

Bitcoin dominance dropped from 60% last week to 55% today, signaling one thing - altseason is officially knocking. And while Bitcoin remains the king, altcoins tend to outperform during this phase.

This is where it gets fun. The irrational markets and meme coin madness are your chance to trade altcoins and stack more Bitcoin (aka sats) for the long haul. Don’t feel guilty about it - it’s all part of the plan. As we like to say, if you’re not using trades to grow your Bitcoin stash, you might as well just HODL.

🎯 What’s On Our Radar for Future Trades?

Solana (SOL): The buzz around a potential Solana ETF and whispers of big tradfi moves have us seriously eyeing SOL. Could this be the next leg up for the blockchain? Stay tuned.

Tron (TRX) & Ripple (XRP) Memecoins: XRP and TRX have been pumping, so naturally, attention is shifting to their memecoins - Sundog on Tron and Army on Ripple. The big question: are memecoins still the narrative, or is the hype running on fumes?

World Liberty Financial (WLFI): Trump’s pro-crypto dream team + some hefty investments into his DeFi project, World Liberty Financial, have us raising eyebrows. Is their ongoing token sale worth a shot? It’s definitely on our list to dig deeper

Avalanche (AVAX): Mark your calendars for December 16th - Avalanche (AVAX) is dropping a major update. Could this be a textbook “sell the news” moment for a quick gain? We will decide soon.

📊 Trading Update

Our Smoking Chicken Fish (SCF) call from Tuesday came through! We snagged it at $0.025, and just a few days later, it hit our 2x target. Naturally, we sold half our stack and celebrated with… well, maybe not chicken OR fish. 🐓🐟

We’ll have a full trading review, fresh updates, and a discussion on what’s next (base on all the juicy events above) coming your way on Tuesday. Don’t miss it!

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research).