4-Year Cycle or Super-Cycle? The Next Months Decide

The uptrend is broken and the bear case is loud... but liquidity, leverage, and politics could flip the script. The next few months decide which cycle wins.

Howdy Hodlers,

Just when you started thinking, “Hey… this might actually be a decent week…”

Boom.

A face-first dip that nuked the vibes and kept bleeding overnight. I guess we jinxed it?

At this point, yeah… it’s probably safe to say it out loud:

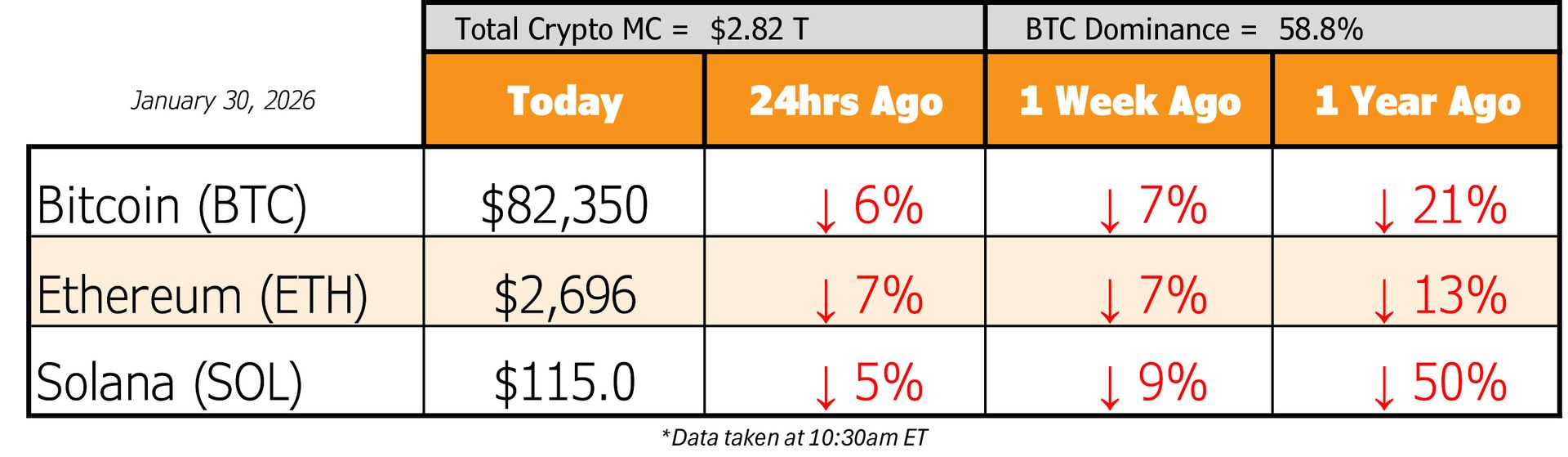

We’re officially in a bear market. 🐻💀

Ready to Plan Your Retirement?

Knowing when to retire starts with understanding your goals. When to Retire: A Quick and Easy Planning Guide can help you define your objectives, how long you’ll need your money to last and your financial needs. If you have $1 million or more, download it now.

Well folks, at least this time, the market didn’t get body-slammed by a single black-swan nuke.

No FTX-style implosion.

No overnight “what just happened?” moment.

Instead, we eased into it.

Slow bleed.

Lower highs.

Acceptance.

An elongated winter, if you will.

Elongated, you say?

Yeah… and that’s where the great crypto civil war kicks off. Which team are you on?

Team 4 Year Cycle

“Bull’s over. See you in 2028.”

OR

Team Super Cycle

“Enjoy this pause, we’re back later this year.”

We don’t have to argue it much longer - the next few months will settle it.

And right now?

The chart isn’t lying. The uptrend is broken.

Which means we’re officially at the mercy of a crypto bear market… and the chaotic headline generator who currently controls macro (Trump).

After last week suing JP Morgan, he’s back at it this week with a bigger target…

But, to make the macro environment even more confusing, a growing narrative says the recent price drops are being driven by falling liquidity, not the expected rising liquidity.

That’s awkward… because everyone’s been told we’re entering a liquidity expansion phase.

Risk-on. Printer warming up. Good times ahead.

So what gives?

Timing.

As we’ve been saying, with Trump staring down midterms, the path eventually points toward more liquidity.

The real question is how long does the wait last? Weeks? Months?

Or… the spicy alternative:

A global recession, the doomsayer favorite.

Our bet?

Trump doesn’t allow it.

He prints his way out. Because that’s what politicians do.

And he already fired the starting pistol by announcing his new Fed chair pick - someone the crypto crowd is actually vibing with thanks to pro-Bitcoin remarks and a friendlier stance on rate cuts than current chair Powell.

Not enough hopium after last night? We don’t blame you, so here’s a bit more from throughout the week.

Here’s the fun part for the degenerates still standing:

Leverage is stacked hard against the shorts right now.

A ton of positioning is leaning bearish… which means it wouldn’t take much upside price action to trigger a short squeeze.

Small move up → shorts liquidated → forced buying → more upside →

✨ green god candle ✨

Will it happen? Who knows.

But a degen can dream.

For now, hang in there. Hopefully the coming week brings a little clarity… maybe even a hint of stability.

Until then..

Trade cautiously. Protect capital. Survive the chop.

What Will Your Retirement Look Like?

Planning for retirement raises many questions. Have you considered how much it will cost, and how you’ll generate the income you’ll need to pay for it? For many, these questions can feel overwhelming, but answering them is a crucial step forward for a comfortable future.

Start by understanding your goals, estimating your expenses and identifying potential income streams. The Definitive Guide to Retirement Income can help you navigate these essential questions. If you have $1,000,000 or more saved for retirement, download your free guide today to learn how to build a clear and effective retirement income plan. Discover ways to align your portfolio with your long-term goals, so you can reach the future you deserve.

Hodl Headlines

The Week’s Most Interesting News

Bitcoin vs. Gold: Key Differences Could Fuel a BTC Rally: Analysts highlight that Bitcoin’s fixed supply and scarcity mechanics distinguish it from gold and could underpin a stronger percentage rally if macro pressure on fiat intensifies. The piece discusses BTC’s underperformance versus gold this year and frames Bitcoin as a potential digital store-of-value alternative in portfolios.

White House to Meet With Banks, Crypto Firms: The White House is convening banking and cryptocurrency leaders to bridge disagreements over key provisions in proposed federal crypto regulation, particularly stablecoin interest and yield offerings. The meeting aims to break a legislative impasse that has stalled the Clarity Act in the Senate.

Bitwise Launches Currency Debasement ETF: Bitwise Asset Management debuted the Bitwise Proficio Currency Debasement ETF (BPRO) on the NYSE, blending Bitcoin with precious metals and mining equities to hedge against fiat currency erosion. The actively managed fund is designed for investors seeking diversified macro exposure amid rising inflation and currency concerns.

Nearly 40% of U.S. Merchants Now Accept Cryptocurrency: A recent PayPal survey finds that nearly four in ten U.S. merchants have added crypto payment options at checkout in response to rising customer demand. A strong majority of merchants expect crypto payments to become mainstream within five years, underscoring expanding real-world adoption.

Crypto Scam Case: Relative of Viral Influencer Pleads Guilty: Brendan Gunn, brother of Olympian viral star Raygun, admitted involvement in an online crypto scam defrauding investors of ~$180K, spotlighting ongoing fraud risks in the sector.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)