A Week in Crypto Time Is a Lifetime in Therapy Bills

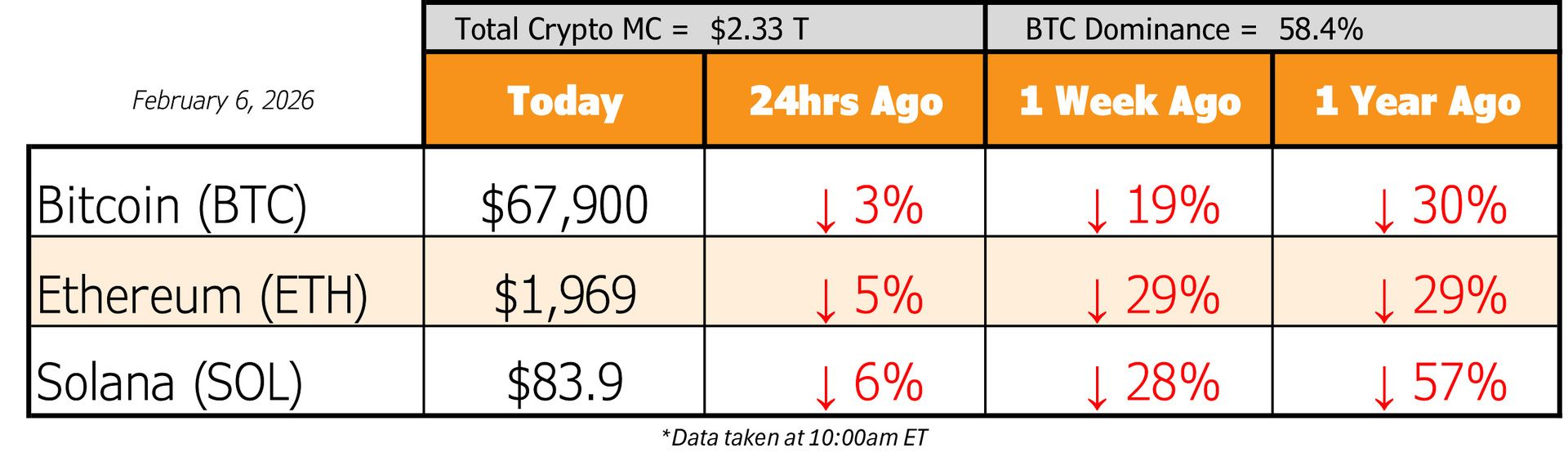

BTC fell from $84K to the $50Ks in a week. Record liquidations, extreme fear, and real pain - but liquidity is coming and the bottom forms sooner than last cycle

Howdy Hodlers,

Wow.

Has it really only been a week?

This time last week Bitcoin was chilling around $84K.

Fast forward seven crypto minutes and we tagged the $50Ks.

Friendly reminder: Crypto time goes faster than normie time.

Last week we officially rang the bell and said, “Yep, bear market confirmed.”

The very next day BTC slid into the $70Ks… and then this week, well - you lived it.

Absolute bloodbath. 🩸

Non-stop notifications coming in to alert us of…

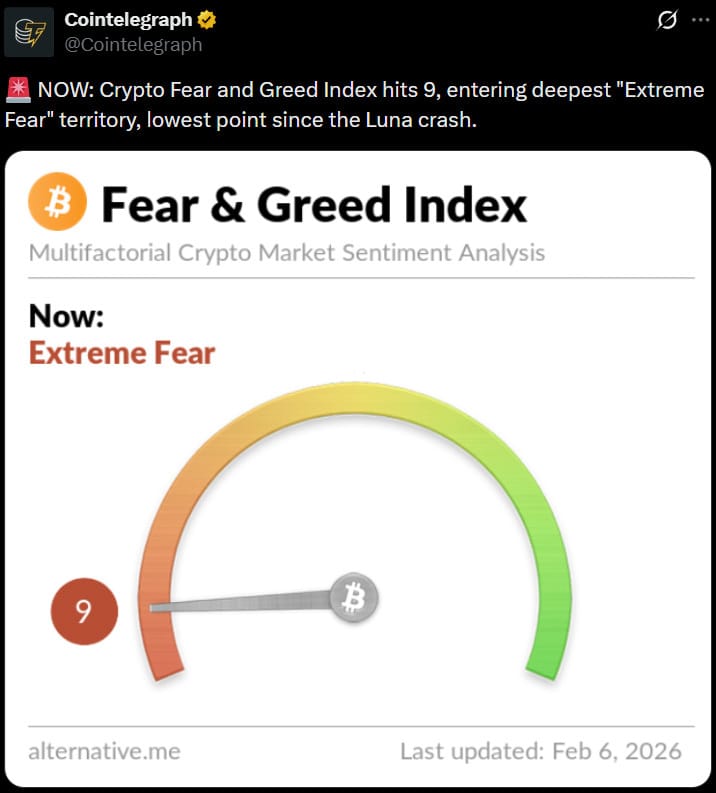

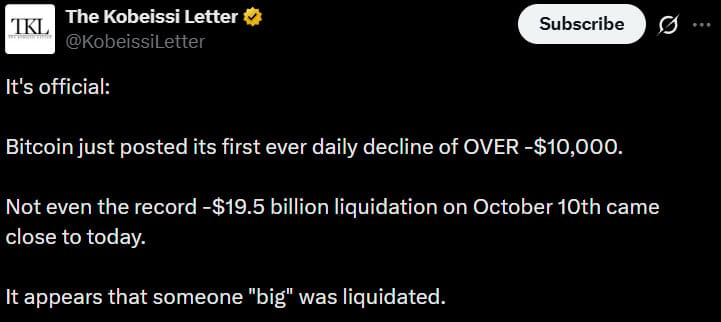

We even set a few records this week with the crash.

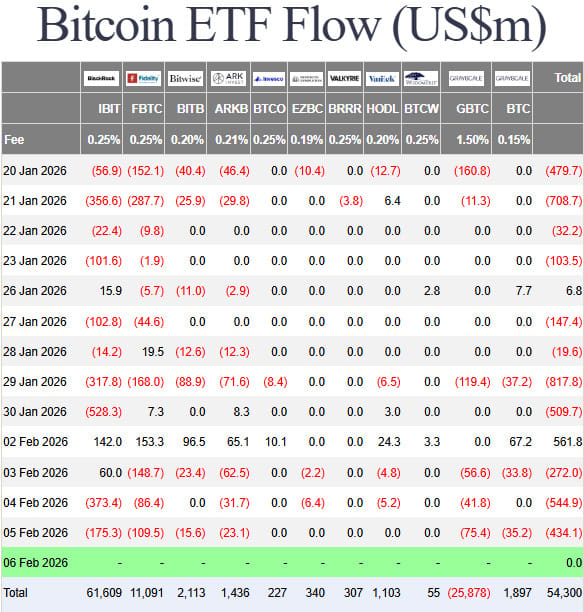

Just look at the Bitcoin ETF flows for the recent weeks.

There are a thousand theories floating around, but the short version is simple:

Macro is ugly. Liquidity dried up. Risk got nuked.

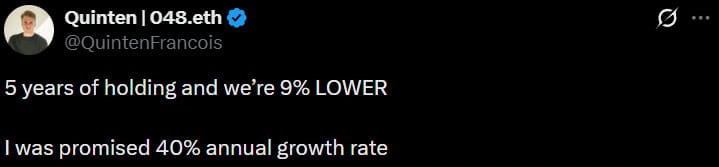

This one sums up the current sentiment nicely.

This doesn’t flip overnight.

Expect more pain over the next few months.

A relief bounce into the $70Ks? Totally possible (in fact it looks like we might be on our way there at the time of this writing).

Liquidity is on the horizon.

Now let’s address the civil war:

The 4-year cycle crowd is right about one thing: the pain isn’t over.

Where they’re wrong? Thinking this drags on for another full year.

This cycle isn’t following the old script line-for-line. The turn from the lows should happen in months, not years, from now.

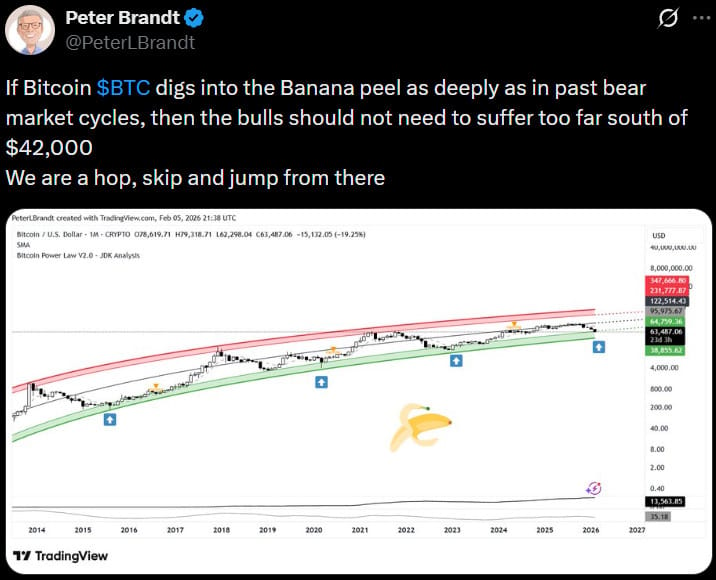

For now though, there’s bottom callers are everywhere - $24K - $35K, $38K, $42K - pick your poison.

That’s how you know we’re deep into the bear already.

In fact the smart guys over at Bitwise seem to think we’ve been in the bear market since Jan. 2025!

Maybe. Maybe not.

But one thing’s certain:

This wasn’t just a dip.

This was a purge.

Survive it, and you’ll be around for the next run.

Miss it, and you’ll be back buying higher with better vibes and worse entries.

Hang in there. 👊

Hodl Headlines

The Week’s Most Interesting News

Bitcoin’s Plunge to $60,000 Hunting For Reason: Bitcoin’s sharp drop toward $60K has market players probing whether leveraged or illiquid funds are being forced into fire-sales, adding to volatility. Traders are scouring on-chain and derivatives data for clues of concentrated liquidations behind the decline.

Bitcoin’s Correlation Software Stocks Is Growing: Bitcoin’s price movements are increasingly tracking shares of struggling software companies, suggesting broader risk-off sentiment is dominating crypto flows. Analysts note this tighter linkage may reduce Bitcoin’s idiosyncratic return profile in the short term.

Tom Lee’s BitMine Now ~$8B Underwater: BitMine, the Bitcoin and crypto investment vehicle led by Tom Lee, is showing a roughly $8 billion unrealized loss as ETH briefly slid under $2,000. The drawdown highlights the risk of treasury-heavy strategies during sharp crypto sell-offs.

Citi Cuts Coinbase Price Target to $400: Citi analysts downgraded Coinbase’s price target to $400 following a roughly 65% collapse from its all-time highs, citing weakening trading volumes and broader market weakness. The revision reflects waning sentiment toward exchange revenues in the current downturn.

Epstein Files Claim Connection to Bitcoin Origins: Newly surfaced legal filings allege fringe connections between Jeffrey Epstein’s estate and claims about Bitcoin’s pseudonymous creator, as well as unrelated Ripple/XRP and Stellar/XLM narratives. Experts dismiss the filings as unsubstantiated and lacking credible evidence.

ARK Invest Sells $17M Coinbase Stock, Buys $18M Bullish: ARK Invest rebalanced its holdings by trimming ~$17 million of Coinbase shares and allocating ~$18 million into Bullish Group stock, signaling tactical positioning in crypto equities. The shift highlights institutional strategy rotation in response to market stress.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)