Bear Trap, Then Moon? This Is Where We Are in the Cycle

Stuck in the chop? History says we’re in the classic bear trap before the real liftoff. Zoom out, stack sats, and prepare for the next leg of the bull run. 🚀

Howdy, Hodlers!

You’re reading the Hodl Report, where the market’s up, then down, then maybe sideways… and predicting the next move is just sophisticated guessing. 🤷♂️

This week, we’re diving into:

🌍 Adoption updates: Who’s joining the crypto cult this week?

🔄 Cycle check: Are we early, late… or just emotionally exhausted?

📰 Top news: Market-moving stuff only.

😂 Memes: Help for keeping your portfolio coping.

Let’s get to it!

Trusted by millions. Actually enjoyed by them too.

Most business news feels like homework. Morning Brew feels like a cheat sheet. Quick hits on business, tech, and finance—sharp enough to make sense, snappy enough to make you smile.

Try the newsletter for free and see why it’s the go-to for over 4 million professionals every morning.

Check it out

Well well well…

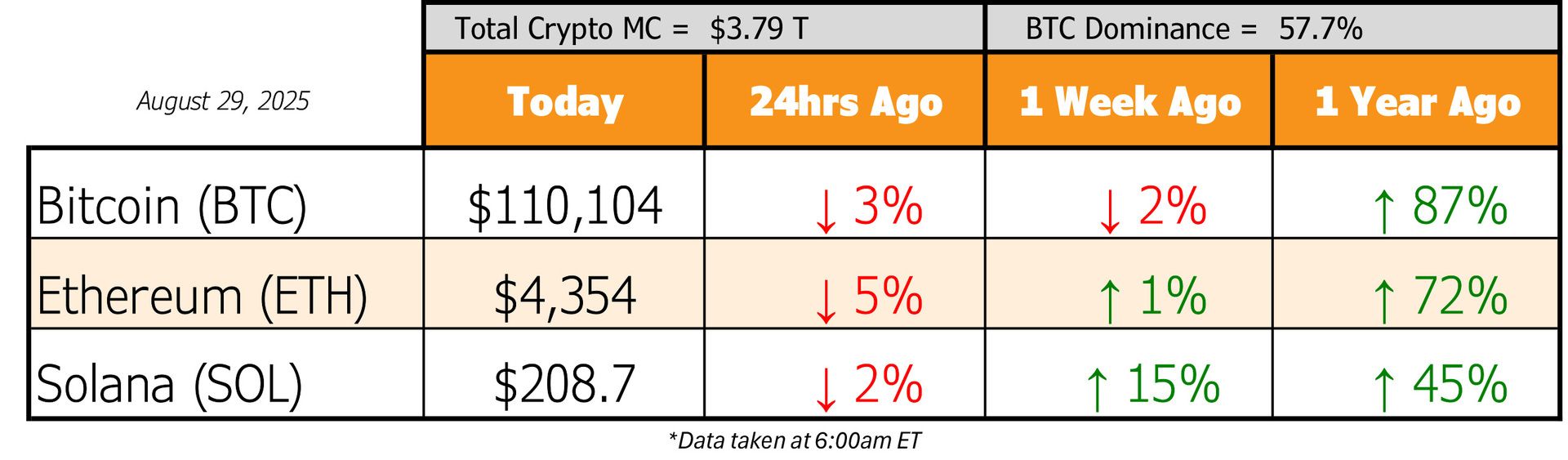

After last weekend’s surprise “Whale goes wild” BTC dump, the market spent this week licking its wounds and crab-walking sideways. That dip came right after fresh ATHs and the Fed officially flipping the switch to “money printer go BRRR” mode.

So yeah, chaos.

Classic crypto.

But beneath the sideways chop, the setup is still looking juicy. We’ve got bullish adoption news rolling in, regulators starting to look more sane, and all eyes are on the real ignition point: September 17th - when the Fed’s next rate cut decision drops.

That’s the day everything changes.

That’s the day the bull run either gets turbocharged or stalls out.

But before we dive into those macro bets, let’s break down this week’s positive adoption and regulation highlights:

1) Google Building Its Own L1?!

Yup. Google just soft-launched “GCUL” - their Universal Ledger L1, designed for big boy institutions, asset tokenization, and payments. They're already testing it with CME Group 👀, meaning Ethereum and Solana might have real competition in the corporate playground.

2) U.S. House Says “No Thanks” to a CBDC

In a surprise move, lawmakers inserted a CBDC ban into the must-pass defense bill. The Fed’s dreams of surveillance tokens just got smacked down, while privacy-focused stablecoins live to fight another day. Power to the people. Or at least... to the privacy nerds.

3) CFTC Opens the Offshore Floodgates

The CFTC is dropping guidance that’ll let U.S. traders legally ape into foreign exchanges. Translation: leverage, exotic alts, arbitrage heaven… all unlocked. Degens, your passport just got stamped.

4) Corporate Accumulation Party Continues 👔

Bitcoin: 174 public companies now hold 989K BTC (4.7% of supply). The 1M milestone is imminent.

Ethereum: 16 companies now hold 3.1M ETH (2.5% of supply). ETH's corporate growth is currently outpacing BTC

Solana: 8 companies holding 3.4M SOL (1.5%). Not bad for the “you’re still early” crew.

TLDR: The chop is temporary. The rate cut fuse is lit. Corporate adoption is booming. Regulators are blinking. And September can’t come soon enough. 🧨

Now, let’s look to the market and make some predictions! 👇

Business news as it should be.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

Bear Trap, Then Moon?

Where We Are in the Cycle?

Whether you’re a 4-year cycle truther or not (👋 we still are), there’s no denying history has repeated itself just enough in crypto to earn some respect.

Zoom out, and you’ll spot it: the familiar emotional arc of the investor psychology chart and it looks like we’re smack in the bear trap right before the liftoff phase.

And what else screams “mid-bull market”?

👉 Degenerate celeb memecoin rugs. Yep. Kanye dropped one. It rugged.

Classic signal for the top is coming.

This ain’t euphoria… yet.

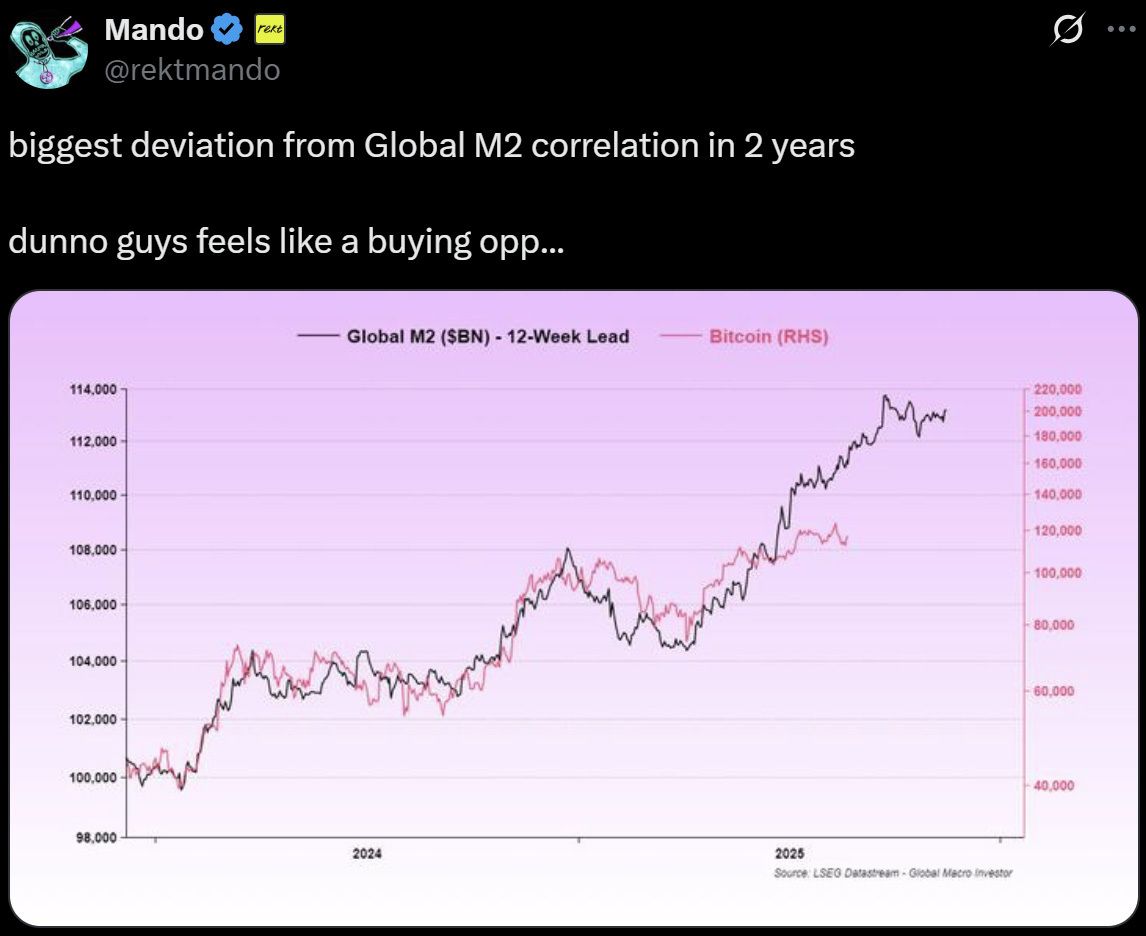

Meanwhile, our go-to macro signal - the Bitcoin vs. M2 Global Liquidity trend - is now off track.

That much divergence? Historically rare.

Historically profitable to buy, too.

Of course, this isn’t financial advice. This is just what we’re doing while the market’s distracted.

We are also witnessing a longer term uptrend for Bitcoin and a retest of support to see if it holds.

If not, it breaks our thesis and maybe the contrarians are onto something.

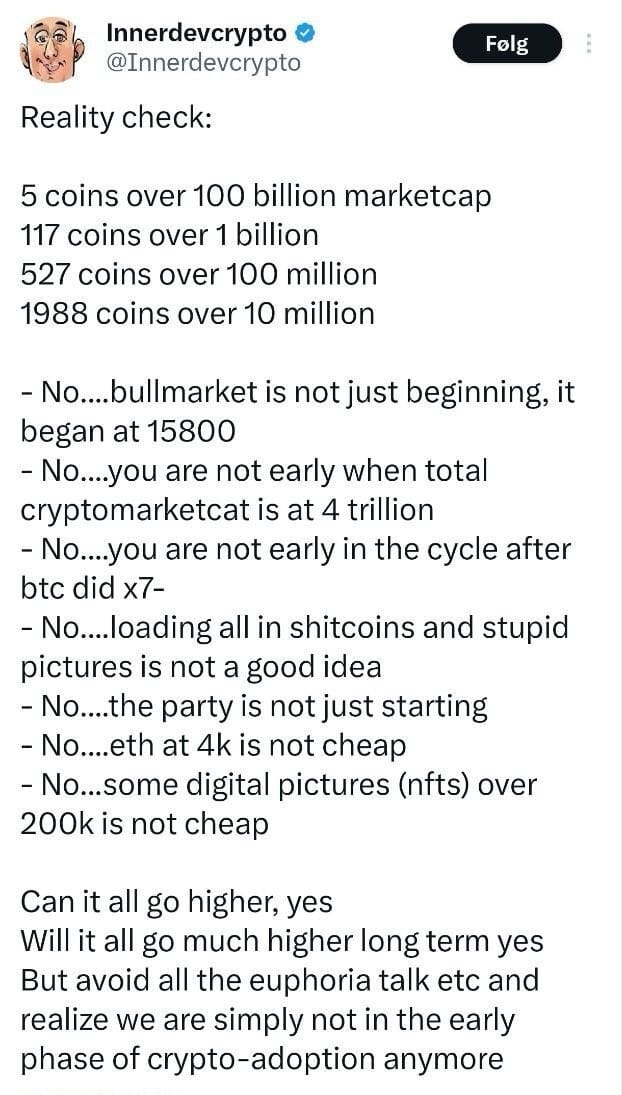

They were chirping this week as well. “We’re not early anymore.” “The top is in.”

But here’s the counter-punch:

Global crypto regulation has never looked better

Corporate & treasury BTC/ETH buys are hitting record highs

Stablecoins are surging

Retail hasn’t even shown up yet

The macro switch to “risk-on” is just waiting for that Fed rate cut signal

All that bullish crypto momentum? Still bottled up under a risk-off macro vibe that’s been acting like a wet blanket on this fire. Let it breathe, and it’s game on.

In the meantime, today we get a fresh dose of inflation data with the PCE report coming out.

Expect some chop, maybe even a retest of support levels throughout next week.

But from there?

📈 Front-running the September rate cuts

📈 Altseason kicking in

📈 New ATHs

📈 And yes - Valhalla.

So let’s just survive these “stress tests” first.

Or as we like to call them…

💰 Discounted entries for the inevitable melt-up. 🚀

Hodl Headlines

The Week’s Most Interesting News

DOJ Drops Charges Against Tornado Cash Developer Coders: The DOJ announced it will not pursue charges against Tornado Cash coders, signaling a shift in how authorities treat open-source developers. Advocates call it a win for crypto innovation and dev rights.

Eric Trump Claims Secret Nation Bought $22B in Bitcoin: At a blockchain summit, Eric Trump hinted that a sovereign nation quietly bought 200,000 BTC, sparking speculation of covert sovereign accumulation strategies.

U.S. Commerce Dept to Publish GDP Data on Blockchain: The Commerce Department plans to release GDP and other economic data on a public blockchain. Officials say this increases transparency and reinforces the U.S.'s pro-crypto policy direction.

UAE Confirms $700M in Bitcoin Holdings from Mining: The UAE has accumulated $700 million worth of Bitcoin through domestic mining operations. The disclosure positions the Gulf nation as a stealth sovereign BTC holder.

Buenos Aires Launches Crypto Tax Payments for Citizens: Argentina’s capital city now allows residents to pay taxes in crypto, including property and vehicle taxes. “BA Cripto” aims to modernize local finance and embrace digital currency tools.

Eric Trump Predicts $175K BTC, Eyes Metaplanet Visit: Eric Trump has publicly predicted Bitcoin will hit $175,000 by year-end and plans to visit Tokyo-based Metaplanet, signaling further Trump-linked institutional interest in BTC.

Tether Bringing Stablecoins to Native Bitcoin: Tether will launch USDT on the RGB protocol, enabling stablecoin use directly on Bitcoin’s layer-2. This expands Bitcoin-native financial tools while enhancing scalability and privacy.

BlackRock’s Calls Bitcoin a Hedge as iBIT Tops 781K BTC: BlackRock CEO Larry Fink calls Bitcoin a hedge against monetary debasement, as the firm's iBIT ETF surpasses 781,000 BTC in holdings. Institutional demand continues accelerating.

Weekend Dip Analyzed: Healthy Pullback or Bull Trap?: Analysts are split on whether Bitcoin’s weekend dip signals a buying opportunity or a momentum loss. Volatility remains high ahead of major ETF flows and macro policy updates.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)