Builders Build, Bulls Buy, Legends Stack

Markets dip, headlines scream - but the real ones? They keep building, buying, and stacking like the bull run’s already here. Stay ready.

Hey there, Hodlers!

You’re reading the Hodl Report, where it’s another week of pump, dump, cope, repeat… and we’re somehow still here for it! 😜

This week, we’re covering:

🌎 Macro madness: Why we pumped, why we dumped, and why we’re confused again.

📰 Top news: The headlines that actually moved markets

😂 Memes: for your mental portfolio

Up, down, sideways - it’s just another week in crypto.

Let’s ride. 🚀

2025: The Year of the One-Card Wallet

When an entire team of financial analysts and credit card experts go to bat for the credit card they actually use, you should listen.

This card recommended by Motley Fool Money offers:

0% intro APR on purchases and balance transfers until nearly 2027

Up to 5% cash back at places you actually shop

A lucrative sign-up bonus

All for no annual fee. Don't wait to get the card Motley Fool Money (and everyone else) can't stop talking about.

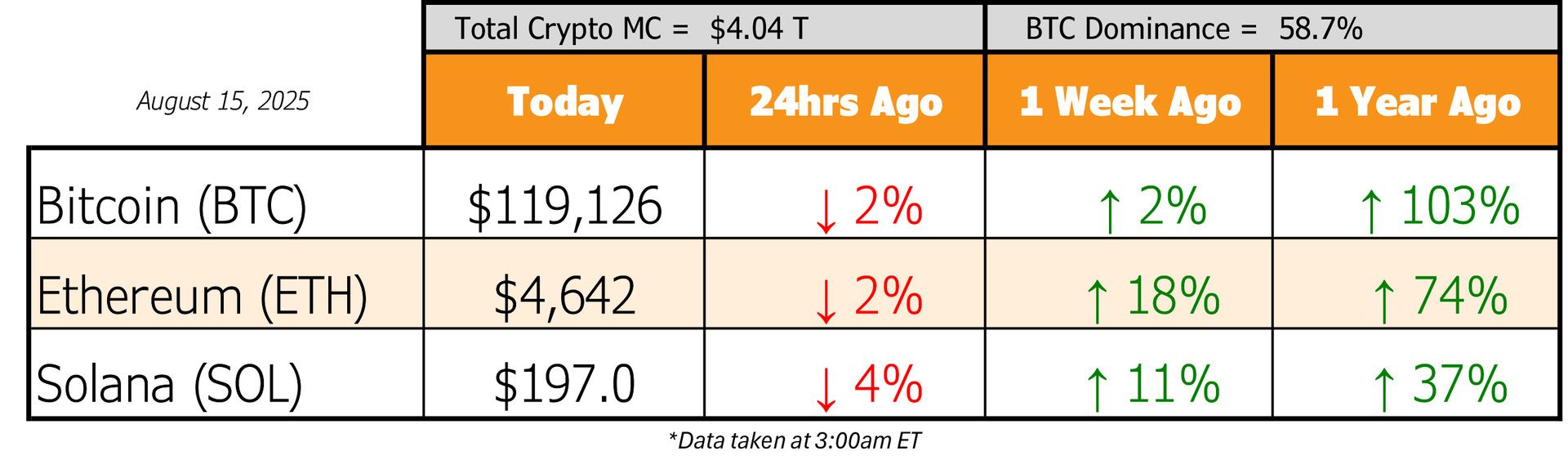

Altseason is clearly gaining steam.

ETH is up 58% in a month, BTC dominance is falling, and DeFi metrics are surging. But, as always, macro had to crash the party.

Right after Bitcoin hit a fresh new ATH, the July Producer Price Index (PPI) dropped a bomb: 3.3% vs. 2.5% expected.

That’s not your typical 0.1% miss - that’s a full-blown inflation spike.

And markets reacted accordingly, pulling back across the board.

So now?

We’re entering support discovery mode for Bitcoin. Given the relentless ETF flows and corporate treasury buying, don’t expect this dip to last long or go too deep.

Looking ahead:

Tariff noise should calm down soon

An Alaska summit could bring progress on the Russia-Ukraine front

September rate cuts are still firmly in play

If this sequence plays out, it sets the stage for a clean run-up into the back half of the year.

The dip is likely just that… a dip.

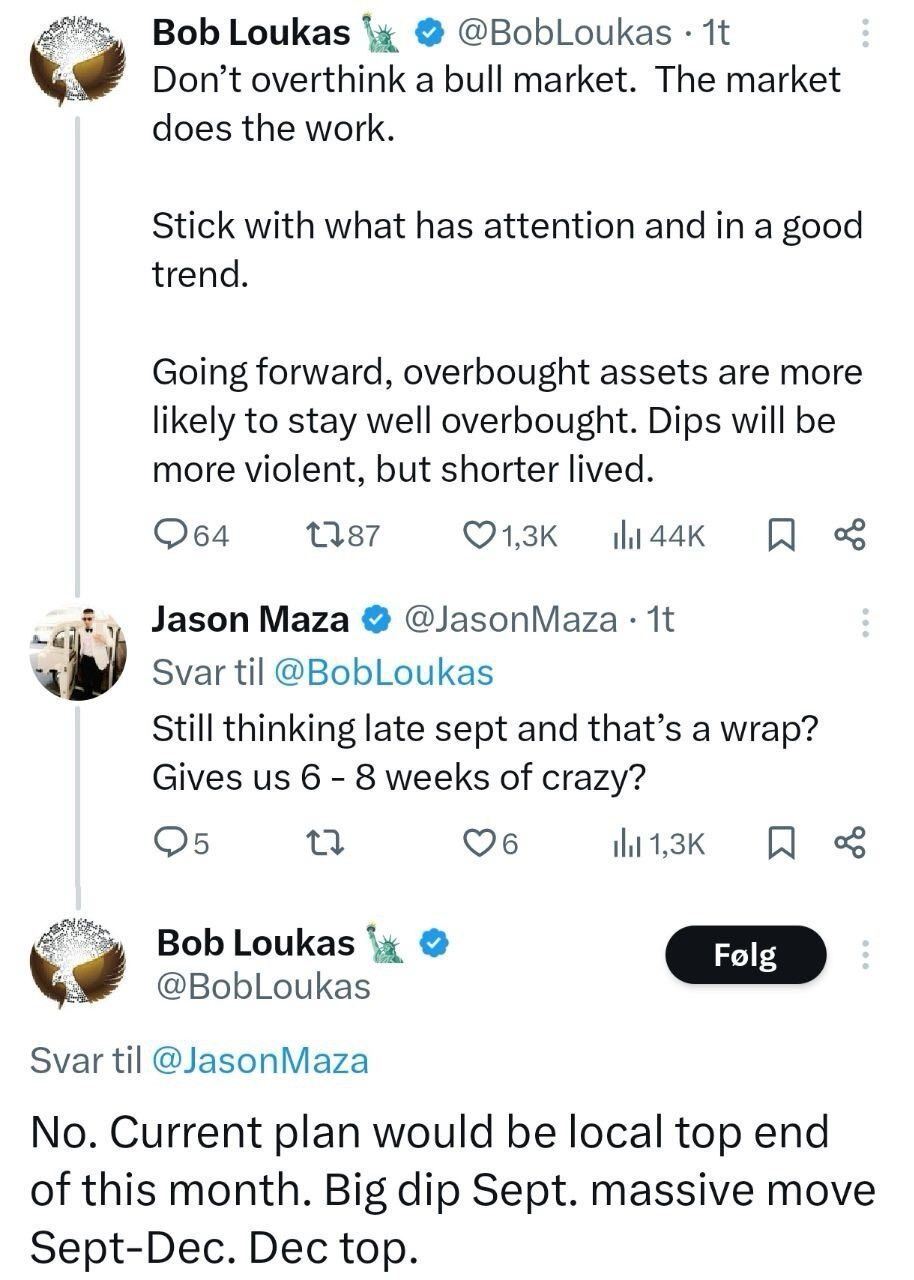

We’re very aligned with this short-term thesis 👇

Adding to this week’s stack of semi-bearish vibes, Bessent doubled down and reconfirmed what we already knew - no surprises, just a reminder.

Now, let’s talk stables for a sec, because thanks to some fresh legislation, the path is finally wide open for stablecoins to go full beast mode

Firstly, MetaMask, the OG Ethereum wallet, is reportedly launching its own stablecoin. Think of the on-chain implications…

And also to consider:

Circle and Stripe announced that they’re launching their own blockchains (yes, really):

Circle: tailored for stablecoin payments, FX, and capital markets

Stripe: built for payments at scale, no fluff

This isn’t just experimentation, it’s infrastructure for a future global digital cash system.

The builders keep building, the bulls keep buying every damn dip, and the long-game legends just keep stacking like it’s their full-time job.

What a week!

How A Small Crypto Investment Could Fund Your Retirement

Most people think you need thousands to profit from crypto.

But this free book exposes how even small investments could transform into life-changing wealth using 3 specific strategies.

As markets recover, this may be your last chance to get positioned before prices potentially soar to unprecedented levels.

Hodl Headlines

The Week’s Most Interesting News

Bullish Stock Ends First Day at $70, Gaining 90%: Bullish, a crypto exchange backed by Peter Thiel, saw its stock jump 90% to $70 on debut, pushing its market cap north of $10 billion. The IPO drew renewed investor frenzy for crypto listings.

8% of Ethereum Supply Now Held in ETFs or Reserves: Roughly 8% of circulating Ethereum is now locked up in institutional ETFs and company treasuries. The trend underlines growing long-term Ethereum demand and decreased liquid supply.

Pump.fun’s Token Buyback Price Averaging 40% Above Market: Pump.fun is buying back its tokens at prices roughly 40% higher than spot, even as its daily revenue drops. Investors see this as aggressive support for token price despite weaker cash flows.

Takeaways From Circle’s First Earnings Call: Circle disclosed plans to launch Arc, a layer‑1 blockchain where USDC will underpin payments, FX, and capital markets by year-end. Q2 results showed strong momentum ($658M in revenue and $126M adjusted EBITDA) despite a $482M net loss driven by IPO-related charges.

BTC‑Turk Halts Withdrawals Amid Hack Report: Turkey’s BTC‑Turk exchange has halted withdrawals following reports of a potential hack. Users are advised to stay alert as the platform assesses the security breach.

AI Agents Will Dominate Ethereum Spending: AI-powered smart contracts are now Ethereum’s largest users of gas fees, outpacing DeFi and NFT activity. The data highlights blockchain’s growing role in supporting AI infrastructure.

Harvard Endowment Invests in BlackRock Bitcoin ETF: Harvard’s endowment has taken a position in BlackRock’s Bitcoin ETF, signaling elite institutional trust in BTC as a mainstream asset.

Research Refutes Myth of Bitcoin Supply–Money Link: Glassnode research busts the idea that Bitcoin is directly tied to money supply growth. Analysts argue BTC’s value dynamics are more nuanced than traditional monetary theory suggests.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)