Bull Market Officially Started

Crypto sprint started, our trades revealed. Don't get left behind

Greetings Crypto Bull-ievers!

You’re locked into the Hodl Report, where the market’s charging ahead - and so are we, with insights sharper than a bull’s horns. 🐂📈

In today’s issue, we’ve got the goods:

Quick macro market recap 🌍

This week’s top news 📰

Hodl Report portfolio update 💼

And some killer memes 😂

Last week, it was Jack Mallers vs. Peter Schiff - BTC vs. Gold, no holds barred!

Now Mallers is back at it, this time breaking down why Ethereum doesn’t make the cut as money (spoiler: it’s all about proof of stake vs. proof of work).

Oh, and if you’re curious what transporting gold vs. Bitcoin looks like…

Whiskey Investing: Consistent Returns with Vinovest

It’s no secret that investors love strong returns.

That’s why 250,000 people use Vinovest to invest in fine whiskey.

Whiskey has consistently matured and delivered noteworthy exits. With the most recent exit at 30.7%, Vinovest’s track record supports whiskey’s value growth across categories such as Bourbon, Scotch, and Irish whiskey.

With Vinovest’s strategic approach to sourcing and market analysis, you get access to optimal acquisition costs and profitable exits.

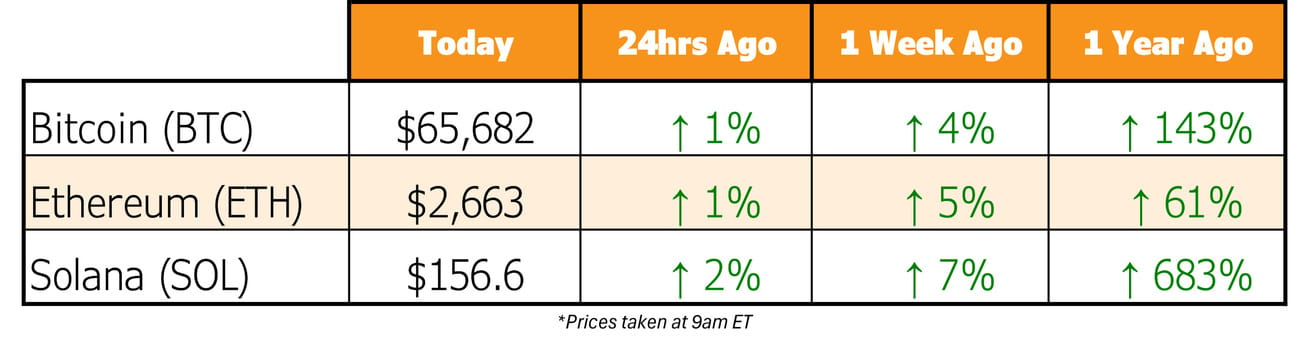

Crypto Twitter has been buzzing with bullish vibes, and it looks like we’re finally nearing the tipping point. Expectations have been running high, but the numbers and prices are finally starting to back it up.

However, the reality is, things are starting to heat up and the two major power moves that kicked off this week’s upswing: China’s big stimulus play and BlackRock going full throttle on crypto marketing.

China’s Stimulus: Return of the Dragon 🐉

China’s economy is making bold moves, aiming for a comeback worthy of an action movie. Beijing has rolled out its biggest stimulus package since the pandemic, cutting bank reserve requirements and slashing interest rates. This move injects over 1 trillion yuan ($137B) into the economy, hoping to revive consumer spending and ease debt pressure.

BlackRock: Bitcoin’s New Hype Machine 🥳

BlackRock is all in on Bitcoin, and they’re not being shy about it. Execs are now talking Bitcoin on Bloomberg like it’s a weekly ritual - something unthinkable just two years ago.

BlackRock also dropped a Bitcoin analysis, pitching it as a top alternative asset and portfolio diversifier for financial pros and traditional investors. Translation: even the big dogs on Wall Street are now joining the Bitcoin fan club.

🐂 Add to the bullish vibes with more short-term events that will build the hype like:

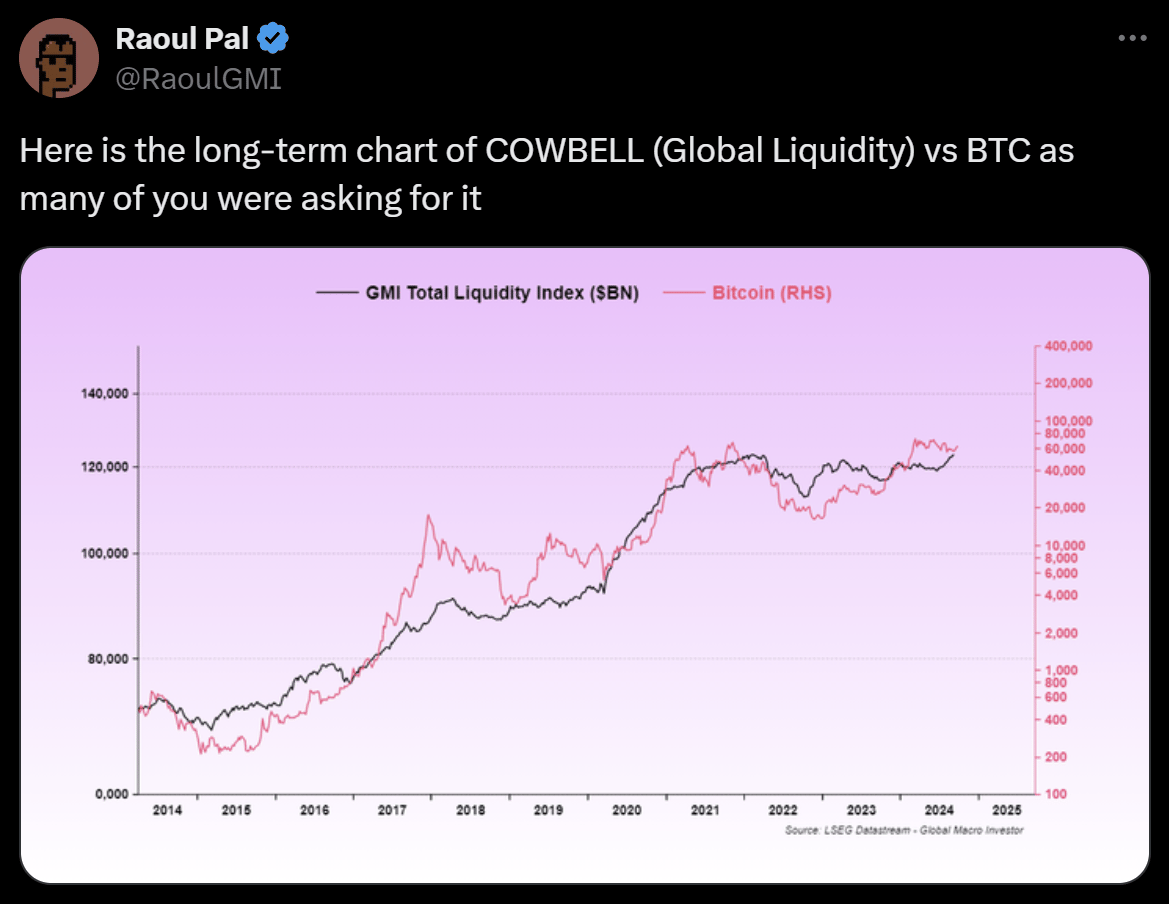

All signs point to this: Global liquidity and Bitcoin prices are headed for a collision course. Buckle up! 🚀

Hodl Headlines

The Week’s Most Interesting News

This week…

12 Years Ago - Bitcoin non-profit organization launches with the goal of advancing the adoption of Bitcoin.

5 Years Ago - Bakkt exchange launches and offers first of its kind futures contracts physically settled in Bitcoin.

BNY Mellon Approved for Bitcoin Custody: Signaling a major institutional shift, BNY Mellon, the world’s largest custodian bank, has received SEC approval to offer custody services for Bitcoin and Ether ETFs.With this green light, BNY Mellon is poised to challenge existing crypto custody providers like Coinbase, reshaping the institutional landscape.

PayPal Expands Crypto Features for U.S. Business Accounts: PayPal has rolled out a new feature allowing U.S. business accounts to buy, hold, and sell cryptocurrencies directly. This move responds to increasing demand from business owners seeking the same crypto services available to retail users. In addition to trading, businesses can now transfer crypto to external wallets.

BlackRock's Bitcoin ETF Sees Record $184 Million Inflows: On September 25, BlackRock's spot Bitcoin ETF pulled in $184.4 million - the largest single-day inflow of any fund this month. This surge comes during a broader five-day streak of inflows across U.S. spot Bitcoin ETFs, totaling nearly $500 million.

SEC and Lawmakers Face Off Over Crypto Regulation: This week, tensions flared between SEC commissioners and lawmakers as they clashed over the agency’s handling of crypto enforcement. Lawmakers from both parties criticized the SEC's vague approach to defining "crypto asset securities" and its aggressive enforcement strategy, raising concerns about the future of digital asset regulation.

Solana’s Stablecoin Market Heating Up with Competition: Sky, previously known as MakerDAO, is expanding to Solana with plans to deploy its stablecoins, USDS and sUSDS. The move comes as Solana’s DeFi ecosystem experiences rapid growth, with Sky aiming to capture market share (where USDC currently dominates) through liquidity incentive programs, similar to PayPal’s recent success with PYUSD.

💥 Use AI to 10X your productivity & efficiency at work (free bonus) 🤯

Still struggling to achieve work-life balance and manage your time efficiently?

Join this 3 hour Intensive Workshop on AI & ChatGPT tools (usually $399) but FREE for first 100 readers.

Save your free spot here (seats are filling fast!) ⏰

An AI-powered professional will earn 10x more. 💰 An AI-powered founder will build & scale his company 10x faster 🚀 An AI-first company will grow 50x more! 📊 |

Want to be one of these people & be a smart worker?

Free up 3 hours of your time to learn AI strategies & hacks that less than 1% people know!

🗓️ Tomorrow | ⏱️ 10 AM EST

In this workshop, you will learn how to:

✅ Make smarter decisions based on data in seconds using AI

✅ Automate daily tasks and increase productivity & creativity

✅ Skyrocket your business growth by leveraging the power of AI

✅ Save 1000s of dollars by using ChatGPT to simplify complex problems

Hodl Report Trading Portfolio

10-10-10 Crypto Sprint 🚀

We are taking $10k and challenging ourselves to turn it into $100k in just 10 months!

The plan? Maximize gains by trading altcoins, but we’re also asking ourselves: Would we have been better off just buying Bitcoin and chillin'? 🤔

Either way, the challenge is on, and we’re off to the races. Follow along as we make our moves and see if we can outpace the king of crypto. Got a good feeling about one of our trades? Feel free to borrow the idea (we won’t tell).

💡 Here’s Our Game Plan:

Target Altcoins: We’re hunting for altcoins with serious pump potential and some solid long term holds.

Strategic Conversions: Once we hit some juicy gains, we’ll lock them in and convert profits back to Bitcoin to build a long-term stash.

Simplicity Rules: No leverage, no hedging - just straight up trades. Keep it clean, keep it simple.

Transparency: Every trade is logged, whether it’s a win, a loss, or somewhere in between. You’ll see it all, no filters here!

👀 How to Follow Along:

Check out our Current Portfolio for real-time values.

Want the details? Here’s the Complete List of Trades.

Curious about the whole challenge? Visit the Challenge Page for all the nitty-gritty.

📊 Let’s Build This Together

Help us help you by making this challenge even better

How do you want to follow our trades? |

Buckle up, because this crypto sprint is about to get wild. Stay tuned for weekly updates, trade breakdowns, and a whole lot of altcoin action! 💰🚀

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research).