Bull Run, Part II. Currently Reloading...

The bull never stopped. DATs stacking, rate cuts coming, retail still asleep. Liquidity flood = next leg up. Strap in, it’s about to get spicy.

Hey There, Hodlers!

This is the Hodl Report, where everyone’s reading and waiting for the bull run to start, but joke’s on them… it’s been on for years. 🐂

This week, we’re looking at:

🌎 Macro outlook: What the big picture’s whispering

🪙 Two hot coins: The tokens everyone’s eyeing right now

📰 Top news: The headlines you actually care about

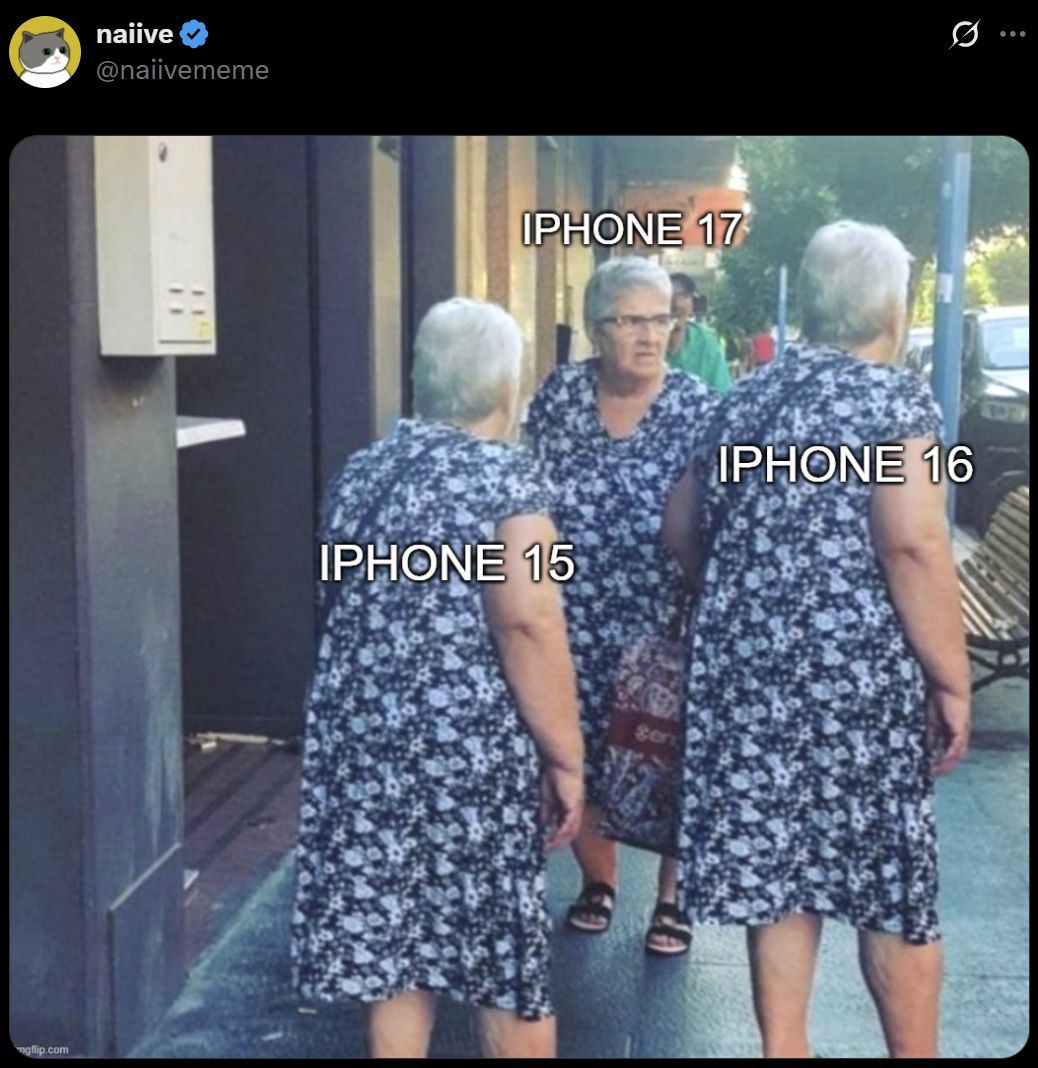

😂 Memes: Let’s keep the hopium alive

Let’s dive in… soon, but first:

As we wrap up your feedback (so we can crank out more of what you love and kill what you don’t), here’s your last shot to chime in.

Takes 2 mins tops, and guarantees your inbox hits different.

Hit the button, bless us with your wisdom.

Unmatched Quality. Proven Results. Momentous Creatine.

Creatine is one of the most effective and well-researched supplements for improving strength, power, recovery, and cognitive performance. Momentous Creatine contains Creapure®—the purest, pharmaceutical-grade creatine monohydrate—single-sourced from Germany for unmatched quality and consistency. Every batch is NSF Certified for Sport®, meaning it’s independently tested for safety, label accuracy, and banned substances.

With no fillers, no artificial additives, and clinically validated dosing, it embodies The Momentous Standard™—a commitment to science-backed formulas, transparency, and uncompromising quality. This is why it’s trusted by professional teams, Olympic athletes, and the U.S. military’s top performers.

Whether you’re starting your creatine journey or returning after a break, Momentous Creatine gives you the confidence of knowing you’re fueling your body with the very best—precisely formulated for results you can feel and trust.

Head to livemomentous.com and use code HIVE for up to 35% off your first order.

Let’s get one thing straight:

The bull market isn’t starting… it never stopped.

We’ve been riding this bull since 2022, whether retail believes it or not. One glance at the chart says it all: higher highs, higher lows, clean uptrend.

We’re not "waiting" for liftoff - we’re mid-flight, baby.

And now?

The engines are about to get supercharged because we’ve got:

📈 Confirmed uptrend continuation

🏛️ Pro-crypto U.S. regulatory momentum

🏢 DATs (Digital Asset Treasuries) forming weekly to do one thing: buy and hold crypto long-term

✂️ A rate cut coming September 17, with odds rising for a juicy 0.50% slash

In other words: liquidity is coming.

And when money gets cheaper, crypto prices get louder.

This week’s market pump? That was just the appetizer.

Revised jobs data showing weakness + cooling wholesale inflation = the perfect excuse for Jerome Powell to hammer the gas on the money printer.

Let’s not forget: retail hasn’t even shown up yet.

This whole cycle has been carried by the suits: treasury companies, ETFs, and governments quietly stacking coins while the normies sit on the sidelines waiting for TikTok influencers to tell them it’s time.

Spoiler: when prices go vertical, retail will FOMO in at the top, just like they always do.

For now?

We’re entering the next leg up.

And while we’ll talk about why these same DATs might someday spark the next crypto winter (👀 that’s for another issue), right now, the trend is up, and the fire’s being stoked.

Let’s dive into two of this week’s attention-hogging coins.👇

AI You’ll Actually Understand

Cut through the noise. The AI Report makes AI clear, practical, and useful—without needing a technical background.

Join 400,000+ professionals mastering AI in minutes a day.

Stay informed. Stay ahead.

No fluff—just results.

🔥 Solana & HYPE

The Two Coins Owning the Spotlight

If you’ve been reading us, you know we’ve been bullish on Solana (and SUI). But right now, Solana is stealing the show, and it’s gunning for a new ATH.

Why SOL is ripping:

ETF Countdown: Seven firms (Bitwise, Grayscale, Fidelity, VanEck, etc.) have filed for spot SOL ETFs. Deadline? Oct. 10. No more delays.

Corporate Bid: Forward Industries raised $1.65B (with Galaxy backing) just to stack and stake SOL. Add in SOL Strategies’ Nasdaq listing on Sept. 9, and we’ve got fireworks incoming.

Tech Upgrade: Faster TPS. Faster finality (150ms). Still sub-penny fees. This is how you scale adoption.

SOL’s already up 20% this week ($204 → $240). Bitwise CIO Matt Hougan even called it the next BTC-at-$40K moment.

Translation: 🚀

But Solana’s not alone in hogging the attention.

The new kid on the block?

Hyperliquid (HYPE).

Why HYPE is cooking:

Revenue Machine: Their perps exchange is raking in millions daily, and they’re using that cash to buy back and burn HYPE tokens.

ETF Buzz: VanEck prepping a spot + staking ETF for the US and Europe. HYPE would be the youngest token ever to hit ETF status.

On-Chain Dominance: For four straight weeks, Hyperliquid has out-earned every other blockchain. Yes, even the big dogs.

Between SOL’s ETF hype train and HYPE’s buy-and-burn flywheel, these two are sucking up all the oxygen in the room.

And rightfully so.

Hodl Headlines

The Week’s Most Interesting News

Strategy Misses S&P 500 Spot Despite Eligibility: Even though Strategy (formerly MicroStrategy) met all technical criteria - liquidity, market cap, and four straight profitable quarters - it was not added to the S&P 500 this rebalance. Analysts believe its heavy exposure to Bitcoin raised red flags for the index committee.

Largest NPM Attack in Crypto History Stole Less Than $50: A major supply-chain attack on NPM libraries targeting crypto wallets infected widely used JavaScript packages; however, so far the thieves have only managed to steal under $50.

Respect the PUMP - Crypto’s Emerging Meme Season: Crypto markets are getting hot again: easing rate expectations, soft inflation data, and Fed cut hopes are fueling speculative flows. Memecoin platform pump.fun is gaining steam while Lido explores token buybacks to try and support value in this risk-on meme cycle.

US Treasury to Map Out Strategic Bitcoin Reserve: A new U.S. bill requires the Treasury to deliver a plan within 90 days detailing how a federal Bitcoin (and digital asset) reserve could operate - covering custody, legal authority, cybersecurity, accounting, and partner oversight.

$1.65B Raised to Initiate Solana Treasury Strategy: Forward Industries has secured $1.65 billion in cash and stablecoin commitments from Galaxy Digital, Jump Crypto, and Multicoin to build a public company with a Solana-focused digital asset treasury. Its goal: become a leading institutional participant in the Solana ecosystem.

Nasdaq to Invest $50M in Gemini in Strategic Partnership: Nasdaq is investing $50 million in Gemini as part of a broader strategic partnership. The deal strengthens Gemini’s position and integrates deeper with Nasdaq’s infrastructure.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)