Final Dip Before Liftoff? Altseason Brewing, Powell on Deck

Markets wobbled on hot PPI data, but Coinbase sees altseason coming. Powell speaks today and one word could ignite the next leg of this bull run.

Howdy, Hodlers!

This is the Hodl Report, where we break down how even just Jerome Powell clearing his throat causes every trader to sweat like they’re 100x long on vibes only. 😬

This week, we cover:

Market vibes check: Up? Down? Yes. 📊

Powell Watch: He’s about to talk, we decode the results 🎙️

Top stories: The ones that matter 📰

Memes: To soften the macro trauma 😂

Let’s get into it - preferably before Jerome does…

Thousands are flocking to 2025’s “It Card”

This leading card now offers 0% interest on balance transfers and purchases until nearly 2027. That’s almost two years to pay off your balance, sans interest. So the only question is, what are you waiting for?

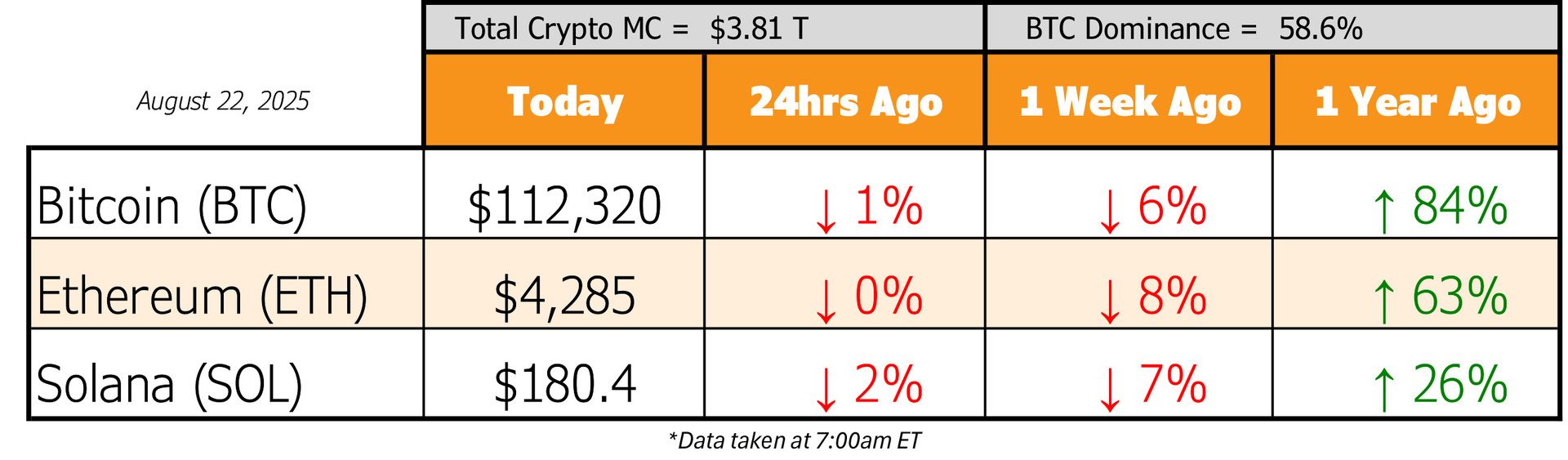

Looks like we're in the summer cooldown before the final fireworks of this bull market.

October and November?

Gonna slap. 😜

But first, we hold through the chop.

Don’t get it twisted though, under the surface the pressure is building.

Coinbase just dropped their Monthly Outlook, calling for a full-blown altseason starting in September.

Here’s why they’re thumping the table:

Fed rate cuts are coming in September - and no, that’s not a local top signal

$7.2 trillion is sitting in money markets waiting to FOMO in once rates drop

Bitcoin dominance just dipped below 60% (a classic capital rotation signal)

Institutional ETH interest and growing treasury demands are undeniable

This isn’t copium… it’s the setup.

The kind that precedes blow-off tops.

And, Coinbase isn’t the only ones thinking the 4 year cycle isn’t dead either…

Sure, the PPI print came in hot (3.3% vs. 2.5% expected) and spooked the market. And yes, we just saw a baby dip after a fresh Bitcoin ATH.

But that’s just the market shaking out weak hands and leverage before its next move.

With all the ETF and treasury company buying pressure under the surface and the pro-crypto regulation slant, any dip is likely short-lived.

We're just retesting support and loading the spring.

Meanwhile, the macro chessboard is shifting.

Powell takes the stage at Jackson Hole today - and every word out of his mouth will move markets.

He’s caught between sticky inflation and slowing growth. The Fed’s in a lose-lose spot, and traders are betting 83% odds on a rate cut in September. That means fireworks are coming.

Here’s how it likely plays out:

Hawkish tone? Prices dip

Dovish lean? We pump

Wait-and-see? Markets chill - but not for long

Powell's walking a tightrope while Trump’s yelling from the sidelines to "cut rates or crash the economy." And let’s not forget the $7.2T powder keg waiting on the sidelines to FOMO into risk once the pivot is official.

Still worried? Zoom out.

Coinbase CEO Brian Armstrong just joined Jack Dorsey and Cathie Wood in the "$1 million Bitcoin by 2030" club. Armstrong rarely makes price calls, so this one hits different. Wood even said BTC could hit $3.8M. Meanwhile, Scaramucci is calling $180K–$200K by the end of this year.

TLDR: Ignore the noise, embrace the chop, and stack while it's cheap.

This is what the final leg before liftoff looks like. 🚀

How A Small Crypto Investment Could Fund Your Retirement

Most people think you need thousands to profit from crypto.

But this free book exposes how even small investments could transform into life-changing wealth using 3 specific strategies.

As markets recover, this may be your last chance to get positioned before prices potentially soar to unprecedented levels.

Hodl Headlines

The Week’s Most Interesting News

Wyoming is First U.S. State to Issue Own Stablecoin: Wyoming is reportedly minting the first state-backed stablecoin in the U.S., aiming to facilitate digital commerce while asserting crypto-forward leadership among states.

Scammer Impersonates Police, Steals $2.8M in Bitcoin: A sophisticated phishing scam in North Wales saw a fraudster pose as a senior UK police officer and trick a crypto holder into entering their cold wallet’s seed phrase, leading to a $2.8 million Bitcoin theft. Authorities warn that law enforcement will never ask for crypto credentials and urge extreme caution.

Fed Ends Specialized Crypto Oversight Program: The Federal Reserve announced it will sunset its “novel activities” supervision program - established in 2023 to monitor banks’ crypto and fintech involvement - and fold crypto oversight into standard banking supervision. The shift marks confidence that banks now manage digital asset risks effectively within existing frameworks.

China Explores Yuan‑Backed Stablecoins: Chinese authorities are reportedly weighing the launch of yuan-pegged stablecoins as a means to promote international use of its currency. The initiative underscores Beijing’s push to modernize digital finance tools and challenge greenback dominance.

BIS Proposes Grading Wallets for AML Readiness: The Bank for International Settlements (BIS) has suggested a new wallet-grading system to assess anti-money laundering standards on public blockchains - hoping to bring structured compliance measures to decentralized finance.

Ex‑White House Director Bo Hines Joins Tether as Advisor: Former White House director Bo Hines has taken on an advisory role with Tether, signaling a push by the stablecoin issuer to strengthen ties with U.S. policymakers.

AMDAX Launches Bitcoin Treasury Strategy: European digital asset firm AMDAX has unveiled a Bitcoin treasury strategy rooted in Amsterdam, aiming to help businesses manage volatility in reserves through BTC exposure.

Bitcoin Tips x “BitBit Spark” Integration Hits Press: A new collaboration between Bitcoin Tips and BitBit Spark is going live - enabling streamlined Bitcoin tipping via a refined interface. Details remain sparse but the rollout signals growing innovation in peer-to-peer BTC payments.

Charles Schwab Expands Crypto Hiring: Charles Schwab is ramping up its crypto-related hiring as regulatory uncertainty fades - preparing to offer digital asset services in a more defined U.S. legal environment.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)