Pro-Crypto President... So Why Does This Hurt?

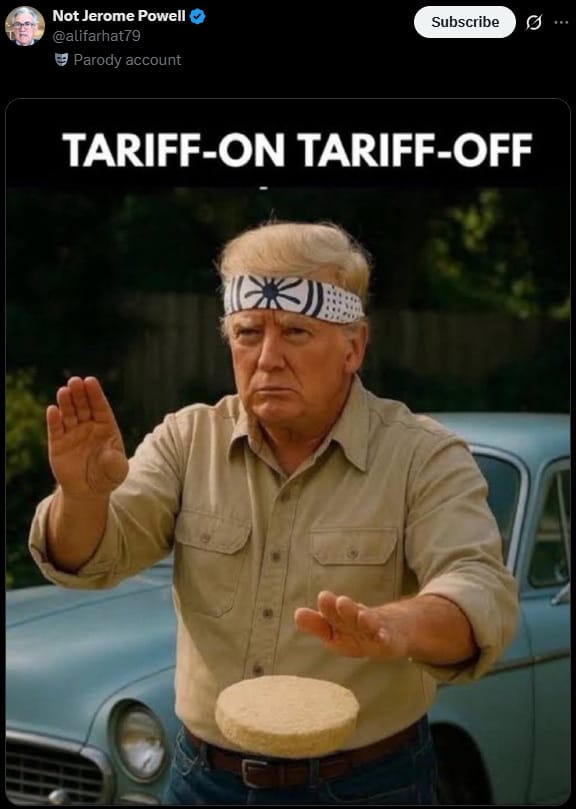

Tariffs on, tariffs off. Trump’s TACO trade returns. Markets swing, gold hedges chaos, and crypto sits at a crossroads one year into a “pro-crypto” presidency

Howdy Hodlers,

Another week, another rollercoaster ride. 🎢

This was one of those weeks where headlines actually moved price — imagine that.

Sure, the swings weren’t early-crypto unhinged levels… but still.

And yeah… we kinda miss the days when candles looked like heart attacks.

Business news worth its weight in gold

You know what’s rarer than gold? Business news that’s actually enjoyable.

That’s what Morning Brew delivers every day — stories as valuable as your time. Each edition breaks down the most relevant business, finance, and world headlines into sharp, engaging insights you’ll actually understand — and feel confident talking about.

It’s quick. It’s witty. And unlike most news, it’ll never bore you to tears. Start your mornings smarter and join over 4 million people reading Morning Brew for free.

Last week we warned the good times might need to bleed first.

Congrats? The market listened.

This week delivered a classic Trump TACO trade straight out of the playbook:

Tariffs on → markets dump.

Tariffs off → markets bounce… kinda.

We’ve seen this movie more times than we can count. It’s Trump’s favorite routine… and for disciplined traders, it’s been a reliable dip-buying opportunity.

So when does it fully rebound?

Consensus says this year, because Trump loves running markets hot ahead of midterms.

Strong economy, strong markets, strong vibes.

Translation: crypto should benefit.

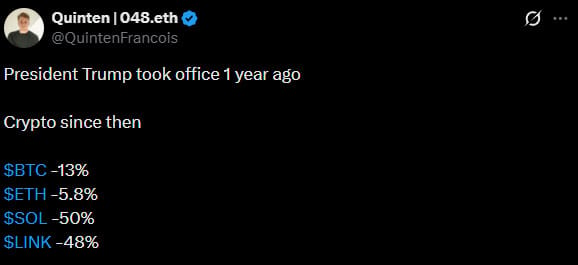

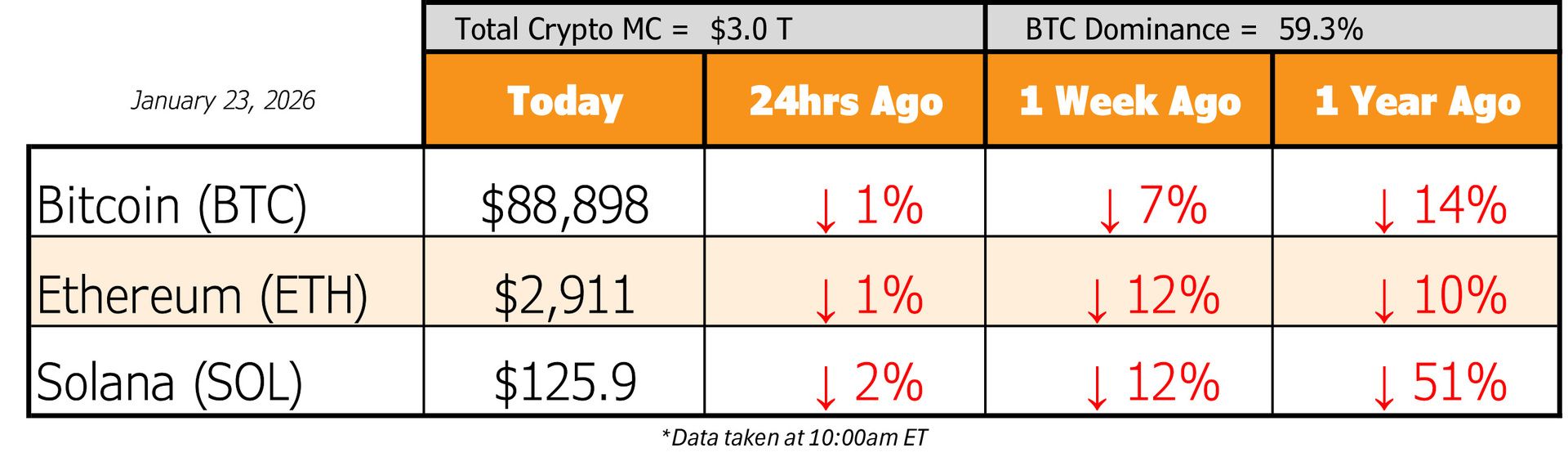

But let’s be real for a second… How are we actually doing one year into a “pro-crypto presidency”?

Yeah… not exactly moon-only.

And honestly? You can feel it.

Crypto’s been eating pain while uncertainty dominates the macro. When chaos runs the show, gold usually shines, and just look at gold’s chart over the past year.

That’s not confidence. That’s hedging.

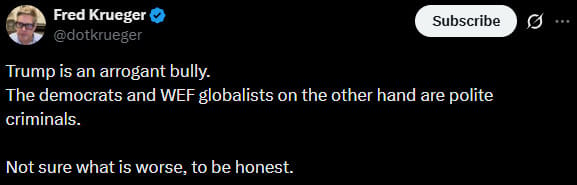

This week’s Davos circus didn’t help.

Trump showed up swinging calling people, countries, and institutions “stupid,” casually explaining Greenland like it was a real estate pitch, then announcing a framework deal had been reached.

Markets popped instantly… but couldn’t quite reclaim prior levels. And have now since retraced.

Missed the speeches? This ought to summarize the feeling…

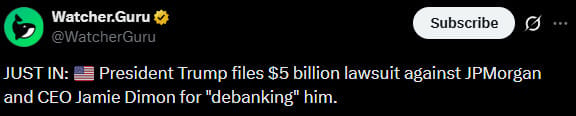

And just when markets were stabilizing, Trump took the opportunity to slide in another headline and this one has two heavyweights going at it… a sitting U.S. president (Trump) suing America’s largest bank (JPMorgan).

Because of course he did.

Never a dull moment.

And to be fair, traders should be thankful. His antics have produced plenty of buy-the-dip opportunities.

They’d feel better, though, if sentiment wasn’t still hanging in the gutter and we were deep in a proper bull run instead of this awkward limbo.

So where does that leave us?

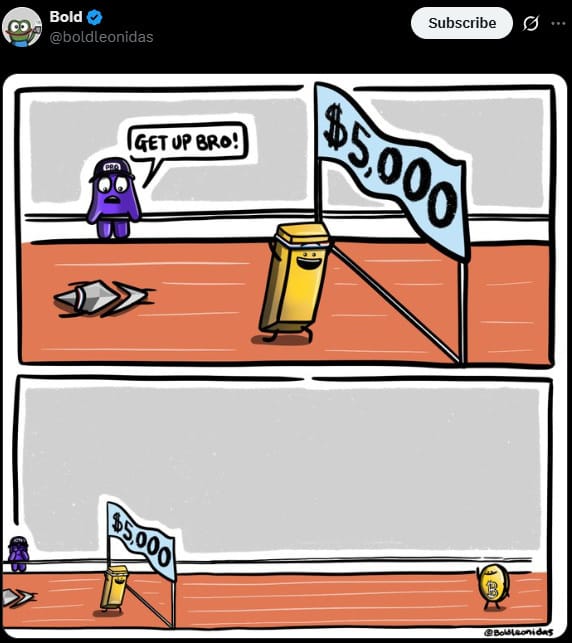

Zooming out, Bitcoin still looks… okay for now.

After reclaiming key levels, the broader trend remains up, but we’re right at the edge. This is the moment where the market decides whether it keeps climbing… or slips again.

At least we’ve got a pro-crypto president, right?

…Right? 😐

All the stories worth knowing—all in one place.

Business. Tech. Finance. Culture. If it’s worth knowing, it’s in the Brew.

Morning Brew’s free daily newsletter keeps 4+ million readers in the loop with stories that are smart, quick, and actually fun to read. You’ll learn something new every morning — and maybe even flex your brain with one of our crosswords or quizzes while you’re at it.

Get the news that makes you think, laugh, and maybe even brag about how informed you are.

Hodl Headlines

The Week’s Most Interesting News

BitGo Goes Public in First Major Crypto IPO of 2026: Crypto custody and infrastructure provider BitGo made its public market debut on the New York Stock Exchange under the ticker BTGO, raising roughly $212.8 million and valuing the company around $2 billion.

Vanguard Buys $505M MSTR Stock and VanEck Bullish: MicroStrategy shares surged after Vanguard disclosed its first-ever $505 million position, while VanEck issued a bullish outlook tied to Bitcoin’s upside. The move reinforces growing institutional exposure to Bitcoin via equity proxies.

Scrutiny on Stablecoins and Financial Surveillanc Intensifies: U.S. policymakers are escalating oversight discussions around stablecoins, focusing on compliance, surveillance, and systemic risk. The debate highlights tension between innovation, privacy, and financial control as stablecoins scale.

Iran Has at Least $500 Million in Stablecoins: Blockchain analytics firm Elliptic reports that Iranian-linked entities have accumulated over $500 million in dollar-backed stablecoins. The findings raise concerns about sanctions evasion and the geopolitical implications of permissionless digital dollars.

Steak ’n Shake Offers Bitcoin Bonuses to Employees: Steak ’n Shake has begun offering workers the option to receive bonuses paid in Bitcoin, expanding real-world crypto payroll adoption. The move reflects growing employer experimentation with digital asset compensation.

Kansas Moves Toward Establishing a State Bitcoin Reserve: Kansas lawmakers introduced legislation that could allow the state to hold Bitcoin as part of its financial reserves. The proposal adds to a growing trend of U.S. states exploring crypto-backed treasury strategies.

Coinbase Allows Borrowing Up to $1 Million Against Staked Ether: Coinbase now allows customers to borrow up to $1 million using staked ETH as collateral without triggering a taxable sale. The product enhances capital efficiency for long-term Ether holders seeking liquidity.

Former FTX Exec. Caroline Ellison Released After 14 Months: Caroline Ellison, former CEO of Alameda Research, has been released after serving 14 months in custody related to the FTX collapse. Her release marks a major milestone in the ongoing legal fallout from one of crypto’s largest failures.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)