Tariffs, Panic, and Hopium - Next Leg Up Continues To Load 🚀

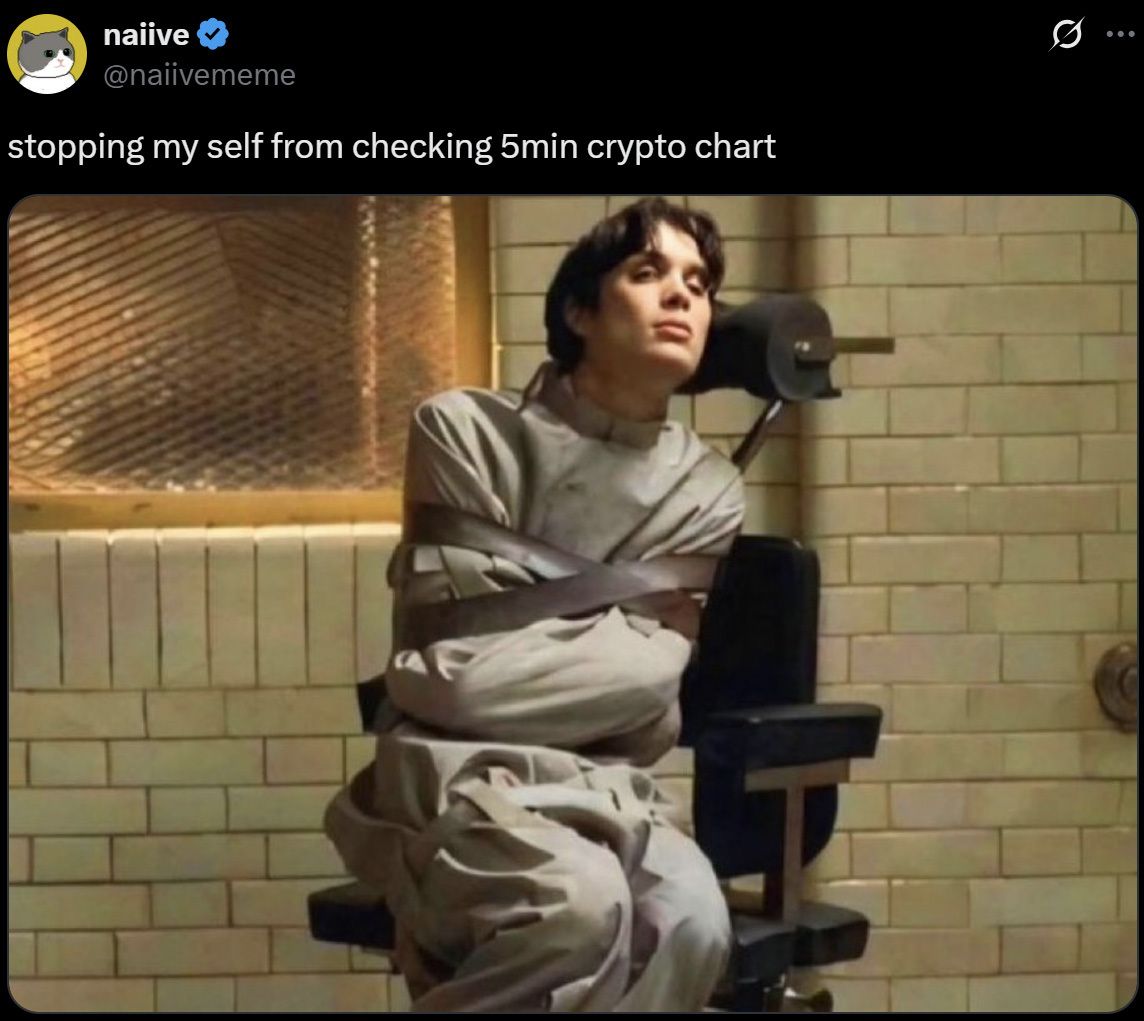

Markets freaked, Bitcoin dipped and gold tanked. Weak hands shaken out, now the setup’s starting to take shape: rate cuts, trade deals, and ETF season ahead.

Howdy Hodlers!

Another week, another loop on the crypto rollercoaster. 🎢

Before you panic-sell your bags, zoom out. The surface looks shaky, sure, but under the hood?

It’s pure rocket fuel waiting to ignite. 🚀🔥

Crypto’s Most Influential Event

This May 5-7 in 2026, Consensus will bring the largest crypto conference in the Americas to Miami’s electric epicenter of finance, technology, and culture.

Celebrated as ‘The Super Bowl of Blockchain’, Consensus Miami will gather 20,000 industry leaders, investors, and executives from across finance, Web3, and AI for three days of market-moving intel, meaningful connections, and accelerated business growth.

Ready to invest in what’s next? Consensus is your best bet to unlock the future, get deals done, and party with purpose. You can’t afford to miss it.

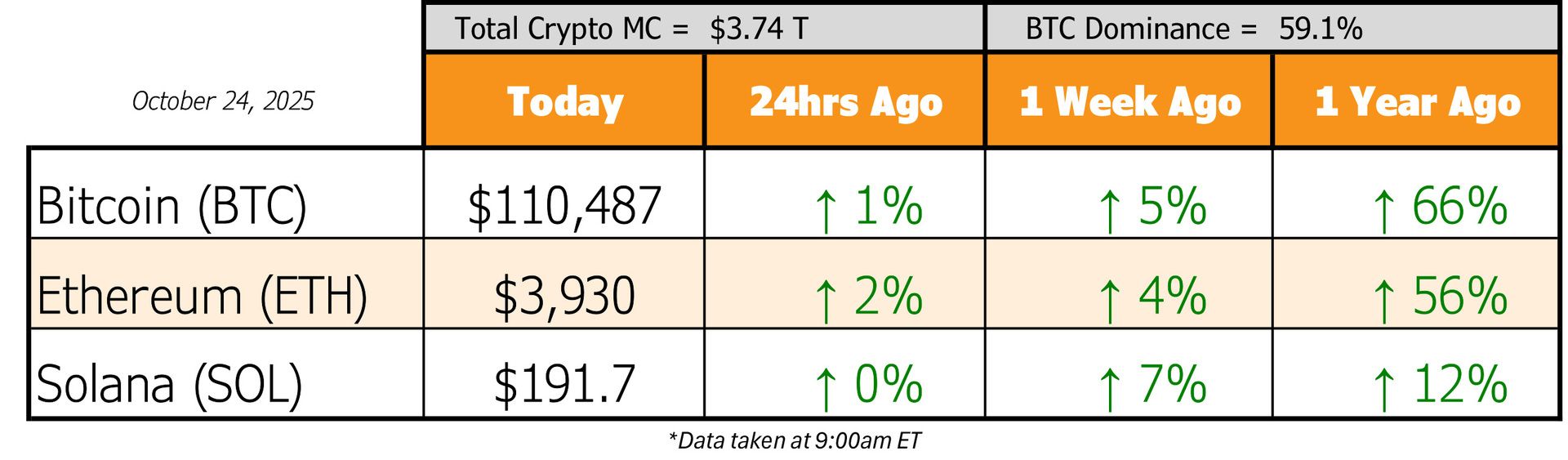

This week Bitcoin kicked things off with a sharp drop to $104K after Trump decided to rattle markets (again) with fresh tariff threats on China.

The result?

Panic, fear, and a wave of paper-handed chaos. But if you’ve been around long enough, you know how this goes… markets overreact, crypto bleeds red, and then… the bounce.

By midweek, Trump walked it back and announced he’ll be meeting Xi next week to “make a deal.”

Translation: the trade war panic that triggered the dump might’ve just created the best buy-the-dip opportunity we’ve seen in a while.

Meanwhile, over in boomer-land, gold got smoked - a casual $1.5 trillion in market cap evaporated in one day. And like clockwork, Bitcoin pumped (although very short-lived). History says Bitcoin tends to lag gold by a few months, so if this correlation holds, we might just be watching the early stages of the great rotation from gold to Bitcoin.

Don’t believe us? Just ask our trusty oracle of all things Bitcoin… NBA hall of famer Scottie Pippen.

If that theory plays out, we’re not just looking at a strong Q4… we’re looking at a fireworks finale to the year.

But before the bulls break out the champagne, let’s zoom out. There are a few key catalysts standing between us and the next leg of this bull run and any one of them could light the fuse:

🤝 US-China trade drama: Trump and Xi are meeting in Korea next week. Prediction markets give a 77% chance of an agreement by Nov. 10th. A friendly photo op alone could flip sentiment bullish again.

🏛️ Government shutdown: It’s dragging on and becoming historic. Once it ends, the money printer fires back up, and fiscal stimulus flows. Betting markets say 56% chance of reopening by Nov. 15th.

💵 QE & rate cuts: The Fed’s lining up back-to-back cuts - 98% chance on Oct. 29th, 97% chance on Dec. 10th. Liquidity flood incoming.

💼 Crypto ETFs: The SEC’s hands are tied during the shutdown, but once they’re back, expect a barrage of ETF approvals and fresh headlines to reignite the bull run.

And because the market loves drama, let’s toss another grenade into the mix… a potential banking crisis. It’s still simmering, not boiling… yet. But if it pops? Another buying opportunity from a dip, gift-wrapped by chaos.

And if you’re hunting for yet another chance to stack cheap sats… Standard Chartered’s head of digital assets, Geoffrey Kendrick, just dropped some spicy hopium with a side of fear: he says a dip below $100K for Bitcoin “seems inevitable” this weekend.

But before you panic-sell your bags he also says it’ll be short-lived. His advice?

“Stay nimble and ready to buy the dip below $100,000 if it comes.”

Because, according to him, this could be the last time Bitcoin EVER trades under six figures. Let that sink in.

So yeah, it’s shaky, it’s noisy, it’s emotional… but we’re not done. Not even close.

The hopium we’ve been serving? Still valid. The top isn’t in. The market just needs to shake out the weak hands before it melts faces again.

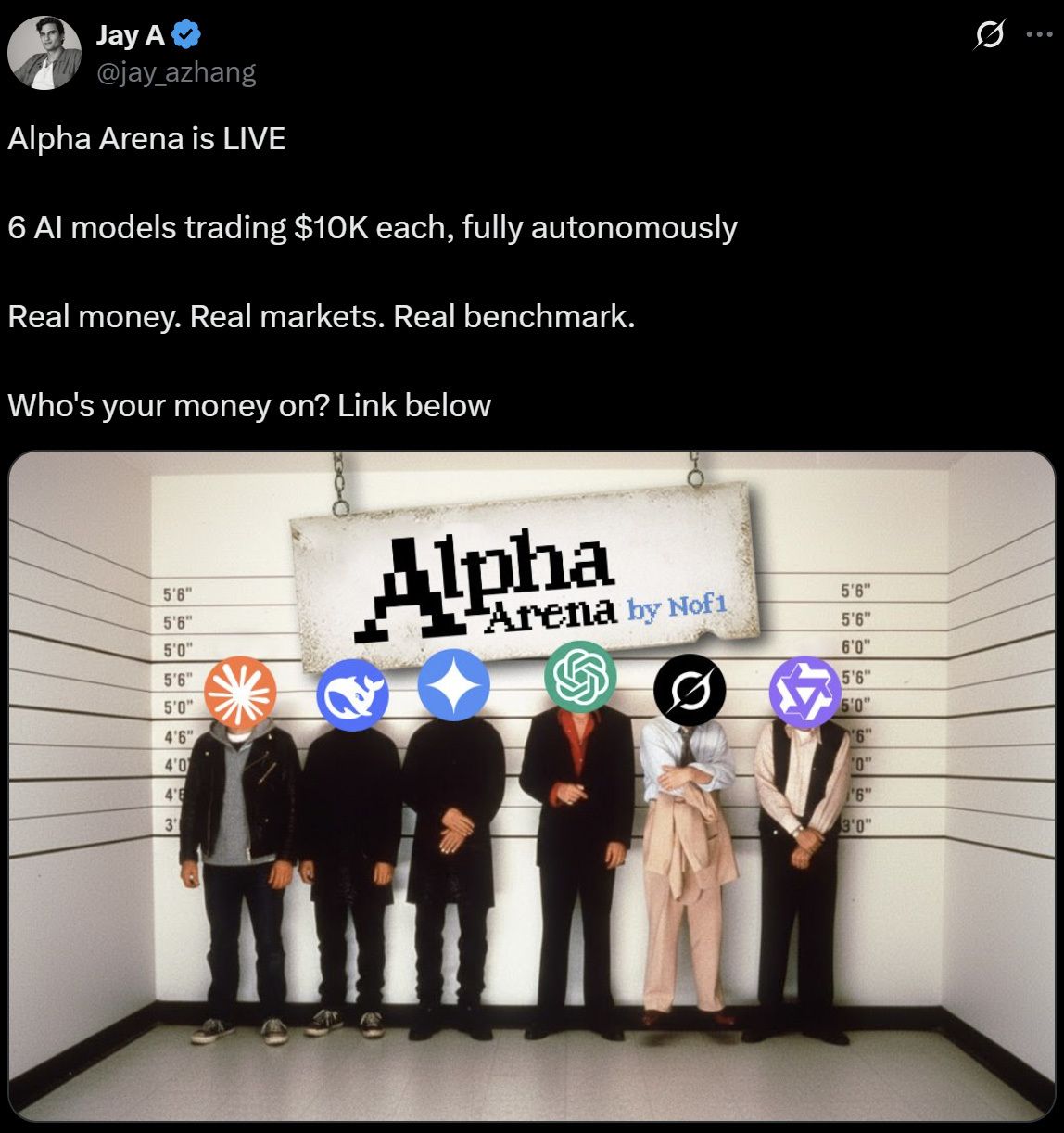

In the meantime, watch some AIs compete in the game we love most - crypto trading!

As we write this, only 2 outta 6 are actually in the green.

So yeah… maybe AI isn’t replacing degen traders - it is one. 💀

Business news as it should be.

Join 4M+ professionals who start their day with Morning Brew—the free newsletter that makes business news quick, clear, and actually enjoyable.

Each morning, it breaks down the biggest stories in business, tech, and finance with a touch of wit to keep things smart and interesting.

Hodl Headlines

The Week’s Most Interesting News

Hong Kong Regulator Approves Spot Solana ETF: Hong Kong’s Securities and Futures Commission has approved the first spot Solana ETF, issued by ChinaAMC (Hong Kong), with trading set to begin on October 27. The ETF allows investors to gain regulated exposure to Solana without managing private keys, marking a major milestone for altcoin adoption.

NHL Teams Up with Prediction-Markets: The NHL has partnered with Kalshi and Polymarket to launch prediction-markets tied to game outcomes, integrating sports events with crypto-enabled trading formats. The move signals growing mainstream acceptance of blockchain-based event contracts.

YouTuber MrBeast Trademarks Plans for Crypto Exchange: MrBeast, the popular YouTuber, has filed trademarks hinting at the launch of a new crypto exchange or platform under his brand. The announcement adds to the trend of influencer-led ventures moving into crypto infrastructure.

Massive AWS Outage Hits Coinbase, Robinhood, Venmo: An AWS outage disrupted major apps including Coinbase, Robinhood and Venmo, underscoring how centralized infrastructure failures can ripple through crypto-adjacent services. The incident raises concerns over resilience in “on-chain” vs “off-chain” architectures in crypto services.

Trump Pardons Changpeng Zhao (CZ): Donald Trump has issued a presidential pardon for Changpeng “CZ” Zhao, founder of Binance, who served time after pleading guilty to laundering-related charges. The clemency marks a major shift in U.S. crypto regulatory posture and could influence future industry enforcement.

OpenSea Pivoting from Marketplace to Aggregator: OpenSea is shifting its business model from a primary NFT marketplace to a trading aggregation platform, letting users compare prices across multiple chains and venues. The move reflects intensifying competition and emphasis on user-flow rather than content ownership alone.

Analyst Says It’s Time to Swap Gold for Bitcoin: One veteran crypto strategist argues that Bitcoin’s structural value is now overtaking that of gold, recommending investors begin swapping out traditional safe-havens for bitcoin exposure. The view reignites debate over Bitcoin’s role as “digital gold.”

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)