The Can Got Kicked... But the Chart Got Better 🔥

Supreme Court delays, regulation stalls, but Bitcoin’s trend improves. Saylor buys big, sentiment rebounds, and $90K becomes the line in the sand.

Howdy Hodlers,

What looked like it was about to be a headline-filled, face-melting week of big decisions… ended with the can getting kicked again.

No fireworks. No follow-through. Just sideways chop and a recovery rally that ran out of steam halfway up the hill.

So… is there still gas left in this thing?

Yes.

Also no.

Let’s break it down 👇

Business news worth its weight in gold

You know what’s rarer than gold? Business news that’s actually enjoyable.

That’s what Morning Brew delivers every day — stories as valuable as your time. Each edition breaks down the most relevant business, finance, and world headlines into sharp, engaging insights you’ll actually understand — and feel confident talking about.

It’s quick. It’s witty. And unlike most news, it’ll never bore you to tears. Start your mornings smarter and join over 4 million people reading Morning Brew for free.

Let’s run through this week quickly, because coming in, it felt like we were lined up for some market-moving bombs.

Supreme Court. Tariffs. Regulation. The whole menu.

Instead?

We got delays, debates, and - shocker - sideways chop.

Here’s what actually dropped:

First up, another Supreme Court punt on Trump’s tariffs. The ruling everyone was bracing for didn’t happen. Again.

Bitcoin actually took this as good news (because uncertainty > bad certainty). On Polymarket, odds of the Court eventually ruling in favor of the tariffs jumped from 22% to 33%. Markets love a kicked can. Who knew?

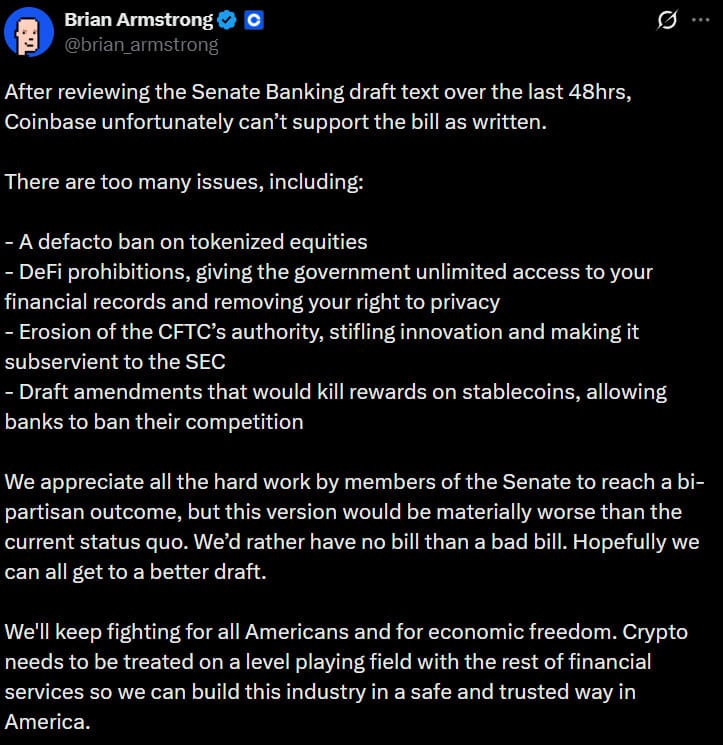

Then came the Market Structure Bill - finally made public… and immediately met with skepticism. In its current form, it’s being viewed as basically unpassable.

That skepticism went mainstream when Coinbase CEO Brian Armstrong publicly pulled support, after which the Senate Banking Committee quietly canceled this week’s markup. Translation: regulation is coming, just not this version and maybe more time needed.

While headlines stalled, price action quietly improved.

The brutal downtrend we’ve been stuck in?

It’s starting to look less like a cliff and more like a slow grind higher.

Nothing explosive.

Nothing euphoric.

Just early signs of a trend trying to flip.

Going into next week, the key level is clear…

👉 Hold $90K

If that base sticks (and barring some world-ending weekend news), we might actually be setting up for a continued push higher.

And of course, it wouldn’t be a crypto week without Michael Saylor showing up with a wheelbarrow of conviction.

This week was one for the record books though!

Strategy (the world’s largest public BTC holder) just dropped its biggest buy since July 2025 - 13,627 BTC ($1.25B total) at a $91,519 average price.

This marks three straight weeks of buying, pushing Strategy’s total stash to:

687,410 BTC

$51.8B total cost

$75.3K average price

Zoom out further and the trend gets louder:

👉 194 public companies now hold 1,107,692 BTC on their balance sheets.

Crypto sentiment has finally started to thaw. The Fear & Greed Index is back up to 61 (Greed) after bottoming at 10 (Extreme Fear) last November.

Not euphoric.

Not reckless.

Just… healthier.

So… Is There Gas Left in the Rally?

The honest answer… Yes and No

Yes:

Tariff ruling still pending

Regulation clarity still coming

Macro liquidity tailwinds still lining up

No:

Liquidity hasn’t actually re-entered yet

Leverage remains elevated

Another sharp flush is absolutely possible if things get crowded (October 10 flashbacks, but lighter)

Short term = trade cautiously.

Long term = keep stacking.

Because one thing is certain - the economy is going to be running hot this year.

And when that happens, asset prices (especially crypto) don’t stay quiet for long. 🚀

All the news that matters to your career & life

Hyper-relevant news. Bite-sized stories. Written with personality. And games that’ll keep you coming back.

Morning Brew is the go-to newsletter for anyone who wants to stay on top of the world’s most pressing stories — in a quick, witty, and actually enjoyable way. If it impacts your career or life, you can bet it’s covered in the Brew — with a few puns sprinkled in to keep things interesting.

Join over 4 million people who read Morning Brew every day, and start your mornings with the news that matters most — minus the boring stuff.

Hodl Headlines

The Week’s Most Interesting News

Crypto Regulation Bill Stalls: U.S. lawmakers failed to advance a long-awaited crypto market structure bill as disagreements over stablecoins and regulatory authority resurfaced. The delay reinforces ongoing uncertainty for exchanges, issuers, and institutional investors awaiting clear federal rules.

Prediction Markets Gain Legitimacy: Blockchain-based prediction markets are rapidly moving into mainstream finance and media, reshaping how probabilities are priced and consumed. The trend signals growing institutional comfort with on-chain forecasting tools.

MrBeast Secures $200M Investment From BitMine: MrBeast’s business empire raised $200 million from crypto-focused investment firm BitMine, led by Fundstrat’s Tom Lee. The deal highlights rising crossover between creator economies and digital-asset capital.

Belgium’s KBC Becomes First Bank to Offer Retail Bitcoin Trading: Belgian banking giant KBC will allow retail clients to buy and sell Bitcoin directly through its platform. The move marks a major step in European bank-led crypto adoption.

Eric Adams–Linked Crypto Project Crashes After Launch: A crypto project associated with New York City Mayor Eric Adams collapsed shortly after launch, wiping out much of its market value. The incident has reignited scrutiny around political figures and crypto endorsements.

Indonesia Emerges as One of the World’s Top Crypto Markets: Indonesia has surged into the top tier of global crypto markets, driven by strong retail participation and growing regulatory clarity. The country’s rise underscores Southeast Asia’s expanding role in digital-asset adoption.

Interactive Brokers Enables 24/7 USDC Funding: Interactive Brokers now supports round-the-clock funding using USDC, with Ripple and PayPal stablecoins set to follow. The move reflects deeper integration of stablecoin rails into traditional brokerage infrastructure.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)