The Fed Cut. TradFi Adopted. Price Still Panicked

The Fed cut rates but BTC dipped anyway. Mixed signals spooked markets - while adoption, regulation, and infrastructure quietly explode. 2026 is loading

Hey there Hodlers,

Pretty uneventful week… except for the Fed cutting rates.

Which, yeah - was fully expected, but still appreciated…

Pelosi Made 178% While Your 401(k) Crashed

Nancy Pelosi: Up 178% on TEM options

Marjorie Taylor Greene: Up 134% on PLTR

Cleo Fields: Up 138% on IREN

Meanwhile, retail investors got crushed on CNBC's "expert" picks.

The uncomfortable truth: Politicians don't just make laws. They make fortunes.

AltIndex reports every single Congress filing without fail and updates their data constantly.

Then their AI factors those Congress trades into the AI stock ratings on the AltIndex app.

We’ve partnered with AltIndex to get our readers free access to their app for a limited time.

Congress filed 7,810 new stock buys this year as of July.

Don’t miss out on direct access to their playbooks!

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

We owe J-Pow a thanks… for not nuking the market by not doing the obvious thing.

Because without that cut? Things could’ve gone real south, real fast.

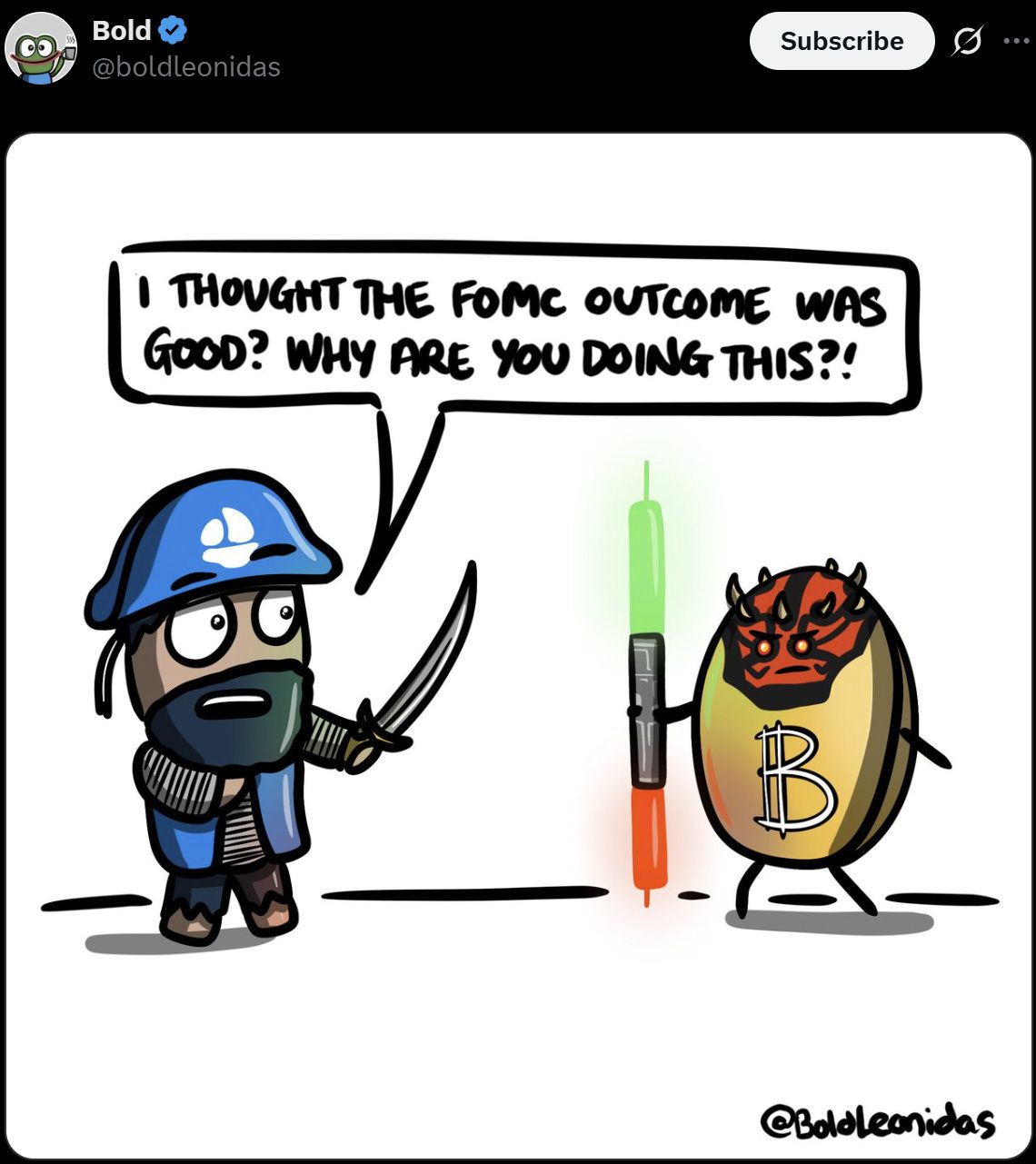

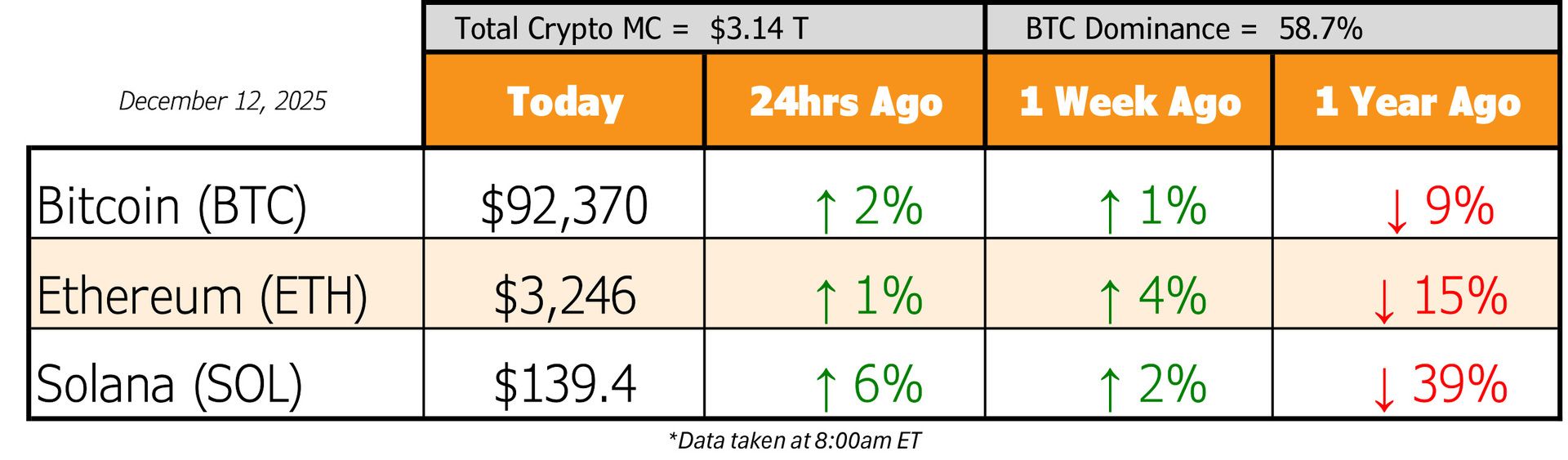

Instead, we got the cut. 25 bps, taking rates down to 3.25%, yet Bitcoin still dumped below $90K like an ungrateful teenager. 📉

Why?

Because the devil is always in the forward guidance.

The Fed basically told markets “relax… but also don’t get too excited.”

They hinted at only one more cut in 2026, not the 2–3 cuts everyone was manifesting. On top of that, six Fed members straight-up voted against this cut. Hawk vibes. Mixed signals. Markets hate mixed signals.

Also important: that $40B Treasury bill purchase program everyone keeps yelling “QE!” about?

Yeah… it’s liquidity management, not the firehose QE that turned 2020–21 into a risk-asset casino.

Still, the key takeaways matter:

👉 The cut is in. Liquidity is coming.

👉 The debate is now how much more cutting, not hikes.

👉 Rate hikes are officially off the table.

Even Powell said it himself, in peak Powell fashion:

“I don’t think a rate hike is anyone’s base case. Rates are either holding here, cutting a little, or cutting a lot.”

Translation: The door only opens one way from here.

Amidst the rate cut spectacle, while price chops and Twitter panics, infrastructure keeps getting built, and it’s stacking up fast. Blink and you could have missed the developments this week:

The CFTC is trialing crypto as collateral (BTC, ETH, USDC). That’s not fringe. That’s plumbing.

U.S. regulators greenlit banks to act as crypto brokers. Yes - banks.

A new ETF application is in the works that holds Bitcoin only during off-market hours.

They’re literally inventing new ways to buy the dip, but also that’s kind of silly and top-signally…

TradFi isn’t “warming up” to crypto anymore. It’s moving in and asking where to plug in the Ethernet.

Meanwhile… Crypto Keeps Shipping

Coinbase came out swinging this week too:

Native Solana token trading inside Coinbase (no wrappers, no nonsense)

Rumors that next week they’ll officially drop:

🎯 A prediction market

📊 Tokenized stock trading

Yeah… Coinbase is quietly becoming a TradFi–DeFi fusion reactor.

And YouTube?

They just integrated USDC payouts for creators. Which makes perfect sense… global creators + legacy banking = operational nightmare.

Crypto solved it. Again.

Another real-world use case quietly checked off the list.

All of this? Just more pipes, rails, and infrastructure getting locked in before the market flips risk-on again.

On the political front, Trump’s been behaving (relatively). No market nukes. No chaos tweets. Just reassuring everyone that markets will go higher, ATHs will be printed, and the economy will be “the strongest ever.”

Some are calling for an extended bull market into 2026 (hi 👋). Others are screaming “4-year cycle, top is in.”

But with:

Weekly adoption announcements

Regulatory clarity improving

Liquidity slowly lining up

And the President basically promising green candles…

Yeah… hard to buy the “it’s over” narrative.

Just to round out your weekly dose of hopium, go watch Raoul Pal break down why 2026 altseason is shaping up to be legendary, and how liquidity dynamics are setting the stage.

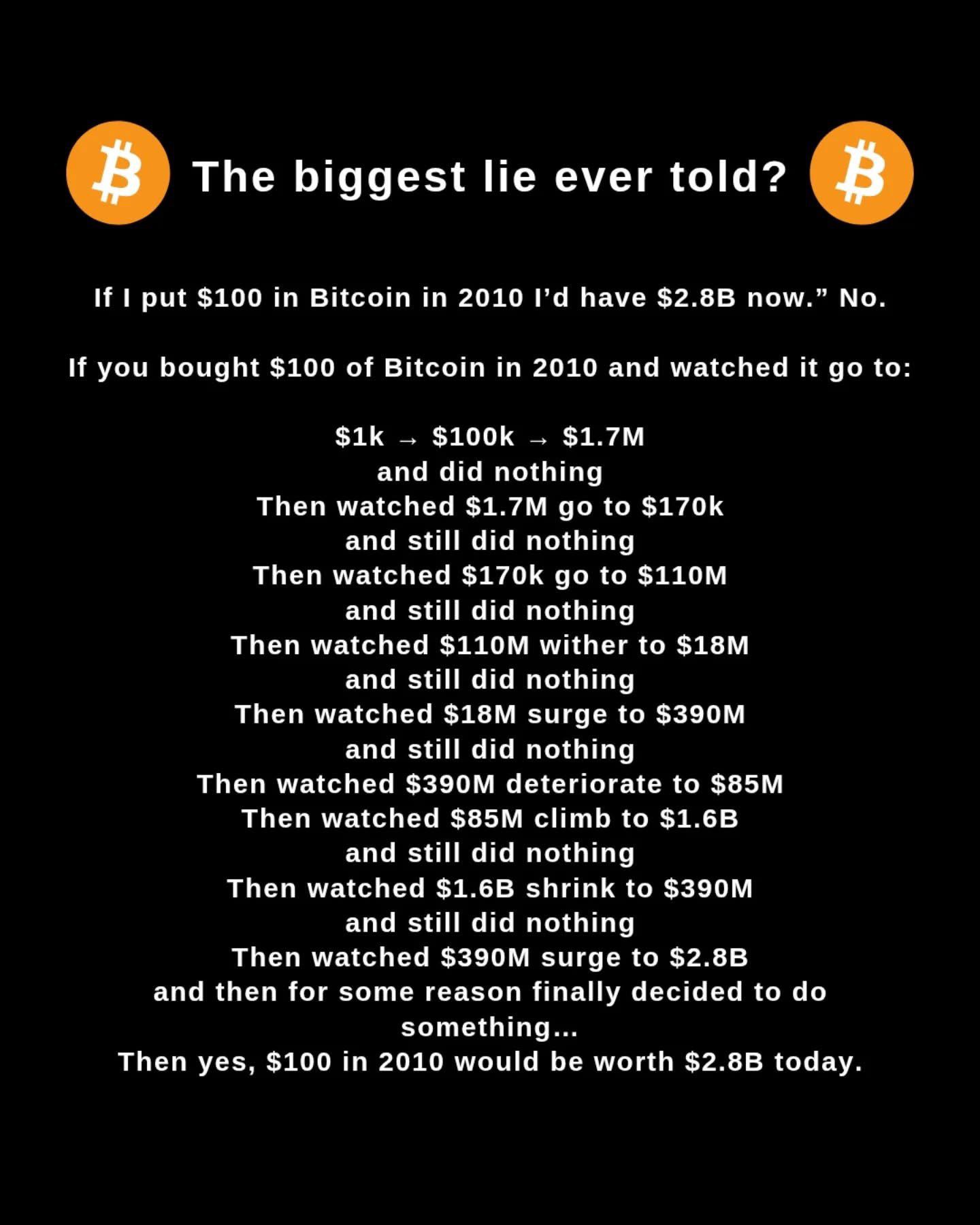

It’s coming. Just not tomorrow.

Until then…

Trade smart.

Survive the chop.

And remember - markets don’t reward impatience.

2026 is loading… 🚀

13 Investment Errors You Should Avoid

Successful investing is often less about making the right moves and more about avoiding the wrong ones. With our guide, 13 Retirement Investment Blunders to Avoid, you can learn ways to steer clear of common errors to help get the most from your $1M+ portfolio—and enjoy the retirement you deserve.

Hodl Headlines

The Week’s Most Interesting News

Coinbase to Launch Prediction Markets and Tokenized Stocks: Coinbase is preparing to unveil on Dec. 17 both on-chain prediction markets and in-house tokenized equity trading, expanding beyond traditional crypto spot and derivatives. The move aligns the exchange with emerging financial primitives and could draw broader institutional and retail interest.

CFTC Launches Digital Assets Collateral Pilot: The U.S. Commodity Futures Trading Commission has rolled out a pilot enabling Bitcoin, Ether and USDC to be used as derivatives collateral, removing outdated restrictions and providing fresh regulatory clarity. The program aims to improve capital efficiency and support broader institutional engagement in regulated markets.

JPMorgan Says There’s No Crypto Winter: Analysts at JPMorgan argue the recent crypto sell-off is a meaningful correction, not the start of a renewed bear market, and emphasize macro fundamentals and structural adoption remain intact. Their commentary suggests institutional confidence endures even amid price weakness.

U.S. Green-Lights Banks to Act as Crypto Brokers: U.S. regulators have clarified that banks can operate as crypto brokers, marking a significant step in integrating traditional finance and digital-asset services. The guidance supports broader institutional participation while underscoring evolving compliance frameworks.

PNC Offers Direct Bitcoin Trading for Private Clients: PNC Bank has started offering direct Bitcoin buy/sell capabilities to eligible private banking clients via a partnership with Coinbase, bringing crypto trading into mainstream bank platforms. The initiative signals accelerating adoption of digital assets in conventional financial services.

Do Kwon Sentenced to 15 Years for Crypto Fraud: Terraform Labs co-founder Do Kwon was sentenced to 15 years in U.S. federal prison after pleading guilty to fraud tied to the collapse of TerraUSD/Luna that wiped out ~$40 billion in value. The judge described the case as an “epic, generational” fraud, exceeding prosecutors’ requested term.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)