This Cycle Broke the Script... Now What?

This bull run felt off - no retail, no altseason. Alts hit new lows as macro tensions and GDP misses weigh on markets. Volatility ahead. Stay sharp.

Howdy Hodlers,

Another relatively uneventful week.

And honestly? Thank you. 🙏

A little up.

A little down.

Nothing nuclear. Nothing euphoric. Just… within range.

New narratives bubbling up. Old uncertainties refusing to leave.

Alright, let’s get into it. 👇

You're overpaying for crypto.

Every exchange has different prices for the same crypto. Most people stick with one and pay whatever it costs.

CoW Swap checks them all automatically. Finds the best price. Executes your trade. Takes 30 seconds.

Stop leaving money on the table.

Be honest.

This bull run didn’t feel like a bull run, did it?

No retail FOMO.

No sovereign buying frenzy.

No taxi drivers pitching memecoins.

And let’s not even talk about altseason.

Because… what altseason?

Alts have been getting absolutely smoked. New lows. Record underperformance. If you’ve been reading us, you’ve (hopefully) been out of alts for a while now.

If not… condolences. 💀

If you’re a trader in this bear market, it’s basically been feeling like this…

And the bad news?

It doesn’t look like relief is right around the corner.

Two big uncertainties are sitting on the market like weighted vests:

1️⃣ Middle East tensions building.

2️⃣ Supreme Court drama over Trump’s tariffs (which just got struck down as we write this).

Add to that a GDP print this morning that missed expectations, and suddenly macro is wobbling again.

Risk assets don’t like wobble. They like clarity.

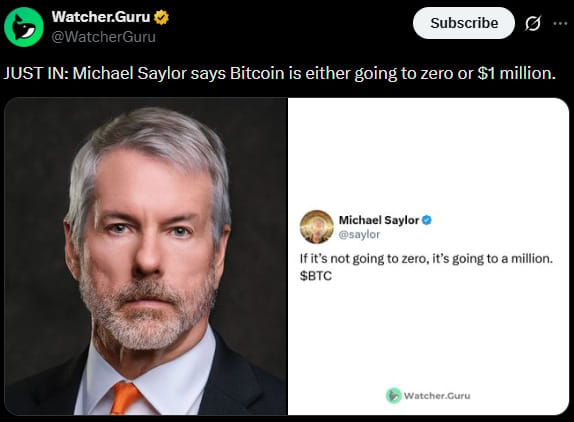

Maybe you’re hoping for calm, rational insight on where Bitcoin heads next.

Best we can do is… extreme.

Because Saylor just dropped another full-send prediction that’ll either age like wine or like milk.

And if you were worried about Strategy’s solvency?

Relax. He addressed that too… and unsurprisingly, he’s not blinking.

Right now, we’re at a macro crossroads.

The economy feels like it’s at a turning point, but nobody knows which direction we’re turning. That’s volatility fuel.

And going into the weekend with TradFi closed and global headlines simmering?

Yeah… crypto might get spicy.

Stay nimble.

Stop overpaying to swap crypto.

The exchange you're using? Probably charging you more than you need to pay.

CoW Swap compares prices across every major exchange in real time. Gets you the best deal automatically. You just swap like normal.

No extra work. Better prices.

Hodl Headlines

The Week’s Most Interesting News

Coinbase Base Network to Drop Optimism for Unified Solution: The Base Layer 2 network, incubated by Coinbase, announced it will phase out Optimism’s OP Stack in favor of its own unified execution environment. The shift aims to streamline Base’s tech stack and improve performance while preserving EVM compatibility.

SEC Officials Say Regulatory Frameworks Coming: SEC Chair and Commissioner delivered remarks emphasizing stable regulatory frameworks over market timing or price-centric objectives, pushing back on short-term Focus on crypto prices. The speech reaffirmed the commission’s emphasis on investor protection and clear rules rather than riding market cycles.

deBridge Introduces Universal API for AI Agents: Cross-chain interoperability protocol deBridge launched an MCP Universal API designed to enable AI agents to interact with multiple blockchain networks seamlessly. The tool is intended to accelerate AI-driven applications across decentralized ecosystems.

Italian Banking Giant Discloses ~$100M in Bitcoin Holdings: Italian banking heavyweight Intesa Sanpaolo revealed it holds approximately $100 million in Bitcoin ETFs, paired with equity hedges via Strategy stocks. The disclosure highlights traditional bank exposure to digital assets and dynamic risk management strategies amid market volatility.

AI Warda Raises iBit Bitcoin ETF Stake: Asset manager AI Warda has boosted its position in the iBit Bitcoin ETF, signaling growing institutional appetite for regulated Bitcoin exposures. The increased stake reflects confidence in ETF inflows even during sideways market conditions.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)