Uptober Still Ready to Go, Don't Fret

A Temporary Delay, In the Meantime Satoshi is Revealed by HBO...Not

Greetings Majestic Memers!

This is Hodl Report, where we decode the crypto world for you faster than your Doge can moon! 🌕🐕

In this issue we’re dishing out:

The market outlook 🌎

Important news from the week 📰

Special Satoshi update ❓

Majestic Memes 🤣

These daily stock trade alerts shouldn’t be free!

The stock market can be a rewarding opportunity to grow your wealth, but who has the time??

Full time jobs, kids, other commitments…with a packed schedule, nearly 150,000 people turn to Bullseye Trades to get free trade alerts sent directly to their phone.

World renowned trader, Jeff Bishop, dials in on his top trades, detailing his thoughts and game plan.

Instantly sent directly to your phone and email. Your access is just a click away!

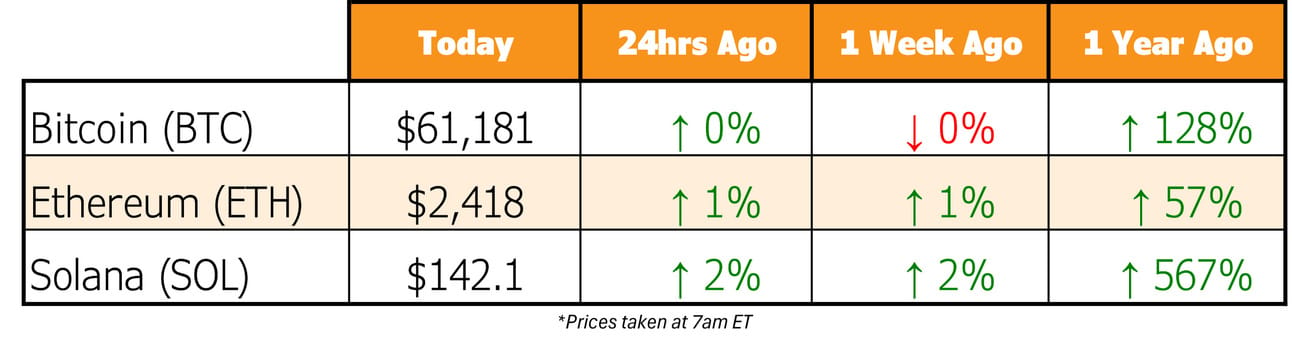

We’re midway through Uptober, but the market’s been a bit shy about taking off - more like Wait-tober so far, right? 😅 [cue chart] 📊

Geopolitical Jitters & Market Moves

Last week, we saw markets wobble on fears of escalating tensions between Israel and Iran. Plus, U.S. port strikes had folks nervous until they were delayed to January (crisis averted, for now!). Over in China, markets sold off after investors didn’t get the mega-stimulus they were hoping for.

All of this is rattling crypto, which, let’s face it, still flinches when global markets sneeze. But don’t sweat it, most of this is just short-term noise.

What Really Matters: Liquidity

Here’s the real story: liquidity. Money supply (M2) is increasing globally, and central banks are loosening up with rate cuts and other measures. That extra liquidity is like jet fuel for the market - a lot of it inevitably flows into crypto as investors and institutions chase that better-than-market yield. 🚀

Why We’re Still Bullish

We’ve got liquidity increasing, potential extra liquidity from China, and rate cuts that make borrowing cheaper - meaning more capital will be looking for higher returns, and that often means riskier assets like crypto. Plus, with the FTX refund on the way, there’s bankruptcy claim payments (paid in fiat) ready to be redeployed. And let’s be honest, where’s that money going? Probably straight back into the crypto market! 💸

What’s Happening in the U.S.: Election Buzz

Speaking of big moves, the U.S. elections are now less than a month away, and they could have a major impact on the market. Right now, the candidate most bullish on crypto (Trump) just took a noticeable lead according to real-money bettors on Polymarket. It’s still early days for Polymarket’s predictive power, but hey, it might be more accurate than those traditional polls we love to argue about!

Diamond Hands: Keep Hodling!

Feeling shaky about the market? Don’t even think about hitting that sell button - just take a cue from the pros. BlackRock, the unofficial "Chief Marketing Officer for Bitcoin," keeps shouting its praises from the rooftops, and MicroStrategy is still buying Bitcoin like it’s going out of style. Oh, and let’s not forget El Salvador - they’ve been doubling down on Bitcoin despite constant pressure from the IMF to cut ties. But President Bukele? He’s not flinching, just Hodling harder. If they can weather the storm, so can you! Stay strong, diamond hands! 💎🖐️

TL;DR: Uptober’s Still Got Potential

So, is Uptober still on? You bet. While the macro noise might rattle markets, the real signal to watch is rising liquidity. Once that flows into crypto, we are off to the races. Stay patient, stay bullish!

Hodl Headlines

The Week’s Most Interesting News

This week…

3 Years Ago - Jamie Dimon says “Bitcoin is worthless”, today JP Morgan is getting in line and has bought in big time…better late than never

FTX Creditors to Earn 119% Profit in Bankruptcy Settlement: FTX creditors are set to earn a 119% return on their claims under a newly approved bankruptcy plan, recovering more than they lost after the exchange's collapse in 2022. The settlement, which involves distributing over $14 billion in assets, represents a major win for creditors, while FTX's former leadership faces ongoing legal battles.

Crypto.com Hit with SEC Wells Notice: Crypto.com has received a Wells notice from the SEC, alleging that several tokens traded on the platform, including SOL, ADA, and BNB, are unregistered securities. In response, Crypto.com is pushing back, claiming the SEC is overstepping its authority by targeting secondary market sales. The outcome of this case could significantly impact future regulatory actions in the crypto space.

SEC Commissioner Admits Crypto Approach Has Been a "Disaster": SEC Commissioner Mark Uyeda recently stated that the agency's approach to regulating crypto has been a "disaster" due to its reliance on enforcement instead of providing clear guidelines. Uyeda acknowledged that the lack of regulatory clarity has hurt the industry, leading to inconsistent court rulings and widespread frustration.

Texas Mayor Says Bitcoin Revitalized Rockdale’s Economy: Mayor Ward Roddam revealed that Bitcoin mining has breathed new life into Rockdale, Texas, which faced economic decline after major industrial closures. The influx of crypto mining operations has created jobs and driven investment, transforming the town into a hub for digital asset infrastructure.

Bitwise to Revamp Crypto ETFs with New “Trendwise” Strategies: Bitwise has filed to convert three of its futures-based ETFs into new "Trendwise" strategies, which will rotate between crypto futures and U.S. Treasuries depending on market trends. The new approach aims to minimize downside volatility and optimize long-term returns, with changes expected to take effect by December 2024.

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

“Money Electric” HBO Documentary Declares…

Peter Todd as Satoshi

In the latest edition of crypto conspiracies, HBO’s documentary “Money Electric: The Bitcoin Mystery” premiered this week, attempting to unveil the man behind Bitcoin. And the big reveal? The film claims Peter Todd, a well-known Bitcoin core developer from Canada, is none other than the elusive Satoshi Nakamoto. 🎬

Directed by Cullen Hoback - who famously unmasked the creator of the QAnon conspiracy - the film tries to build a case that Todd, age 39, has been the mastermind behind Bitcoin all along. Todd has been involved with Bitcoin since 2010 and is a respected figure in the space, but... is he the guy? The case presented by Hoback is, well, let’s just say it's a bit of a stretch.

The "Evidence" (Air Quotes Required)

Here’s the rundown of the hard-hitting clues Hoback throws at us to pin Todd as the creator of Bitcoin:

Forum Post Slip-Up: In 2010, Todd responded to a post by Satoshi on BitcoinTalk. Hoback argues that Todd meant to continue the conversation as Satoshi, but accidentally replied under his real name. Oops? Or just… nothing?

Todd Knew Adam Back: Todd was familiar with Adam Back, a cypherpunk who exchanged emails with Satoshi. So, if you know a guy who knows a guy, you must be Satoshi, right?

British/Canadian Spellings: Todd is Canadian, and Satoshi used British spellings in his writings. Apparently, this is rock-solid evidence, because we all know no one else ever uses the word "favourite."

Todd’s Technical Background: Todd has been into cryptography since he was young and had the technical chops to pull off creating Bitcoin.

Crypto Community Reaction: Not Buying It

Crypto X and most of the community immediately pointed out that Hoback’s claims are based entirely on circumstantial evidence. No direct proof, no bombshells - just a lot of connecting random dots. Naturally, Todd himself found the whole thing pretty amusing.

Conclusion: Fun Theory, Zero Proof

At the end of the day, the documentary might be entertaining, but it fails to present anything close to solid evidence. For now, Peter Todd is sticking to his day job, and Satoshi Nakamoto remains as mysterious as ever. Maybe next time, HBO.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research).