Not Crypto Winter... Just a Painful Pit Stop

New lows, extreme fear, whales selling, but fundamentals keep getting stronger. Hopium inside.

Howdy Hodlers!

The short-term bear grind rolls on, but who said pain can’t be fun? 🥲

Long-term players are getting chef-kiss dip buys, while the short-term degens are eating well off this glorious volatility buffet.

But the real question…

How long until the suffering ends and we return to our regularly scheduled up-only fantasyland?

Let’s break it down. 👇

Retirement Planning Made Easy

Building a retirement plan can be tricky— with so many considerations it’s hard to know where to start. That’s why we’ve put together The 15-Minute Retirement Plan to help investors with $1 million+ create a path forward and navigate important financial decisions in retirement.

Another week, another support level face-planted into the abyss.

New low? Yep.

Déjà vu? Absolutely.

The shorters are eating like kings right now - printing gains while the rest of us stare at the chart like it owes us money. Every day it’s another headline and another message to us from various group chats that goes something like:

“$XXX million in longs liquidated.”

Rinse. Repeat. Cry.

And the question on everyone’s mind… When does this script flip?

Short answer: Not yet.

Long answer: Still not yet.

We covered the current market mentality last week, but let’s quickly recap the vibe:

Markets going full risk-off

Funds locking in gains before year-end (selling pressure)

Funds realizing losses for tax harvesting (selling pressure)

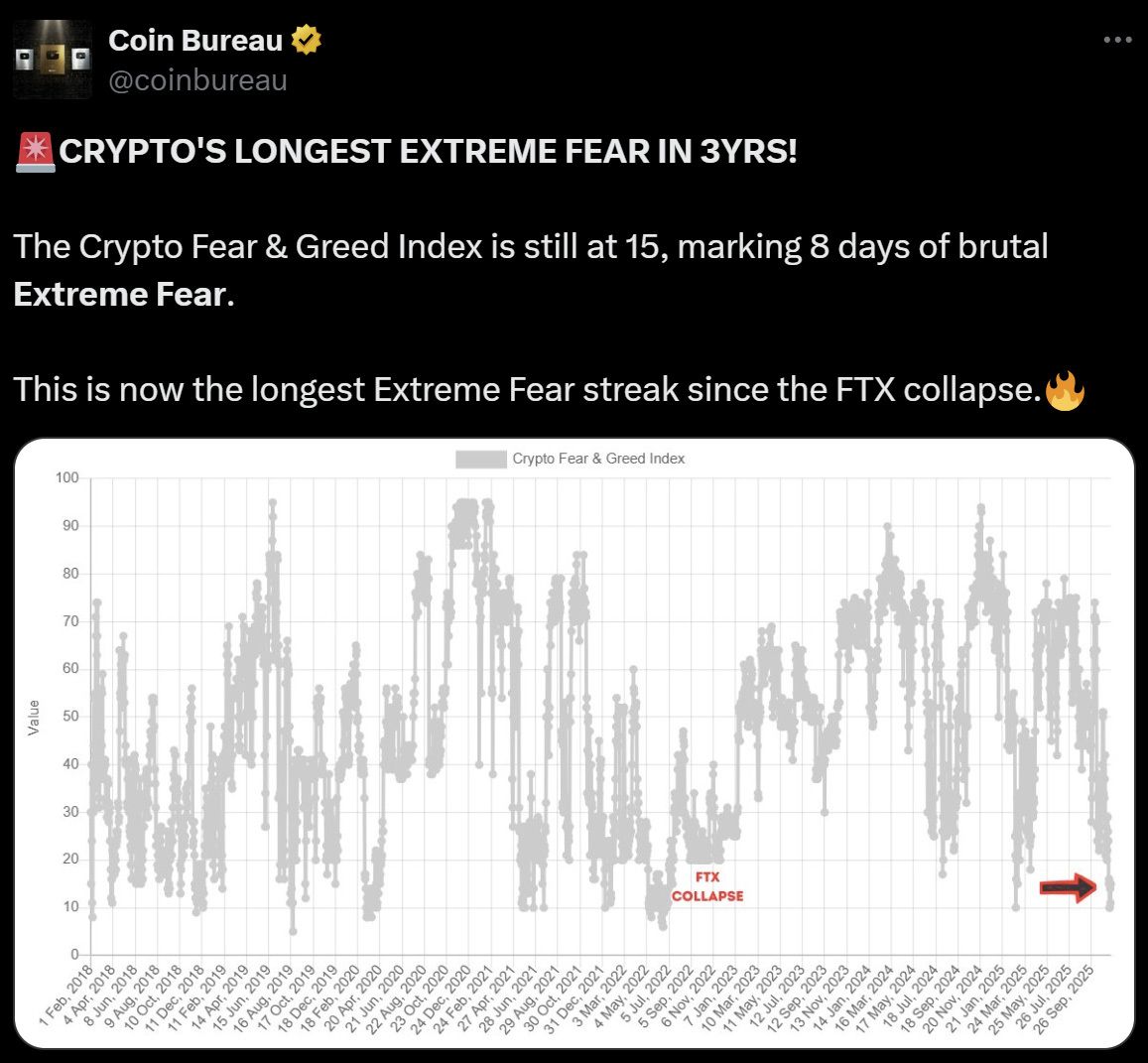

Sentiment has been stuck at extreme fear for the longest stretch since the Terra/Luna/FTX apocalypse.

Adding to this, Morgan Stanley strolled in this week like the Grinch to declare “no December rate cut,” and the market did exactly what the market does… dumped harder.

Polymarket odds of a rate cut collapsed from 70% last week to 35% at the time of writing.

But don’t panic. This “no cut” is mostly because the government shutdown screwed up the data. The Fed isn’t cutting because they literally can’t see what’s happening. Once December rolls around with fresh data, things get clearer.

Still looking for a reason this market feels drunk and directionless?

We already walked through the Bitcoin “silent IPO” theory a few weeks back, and now the market structure theory and the AI theory are joining the party.

Three explanations, one vibe: pure chaos.

Now enough doom and gloom, time for some hopium (the whole reason you tune into us)...

While price action looks like a toddler throwing themself in a tantrum on the grocery store floor, fundamentals keep leveling up. This week:

El Salvador aped in for 1,090 BTC during the dip (over $100M worth). Not their usual 1-BTC-a-day diet. Pure giga-chad move.

Multiple nation-states quietly stacking BTC behind the scenes. Governments buying dips? That’s how adoption goes parabolic while setting the stage for larger buys in the future.

All that great stuff aside, here’s the real hopium hit:

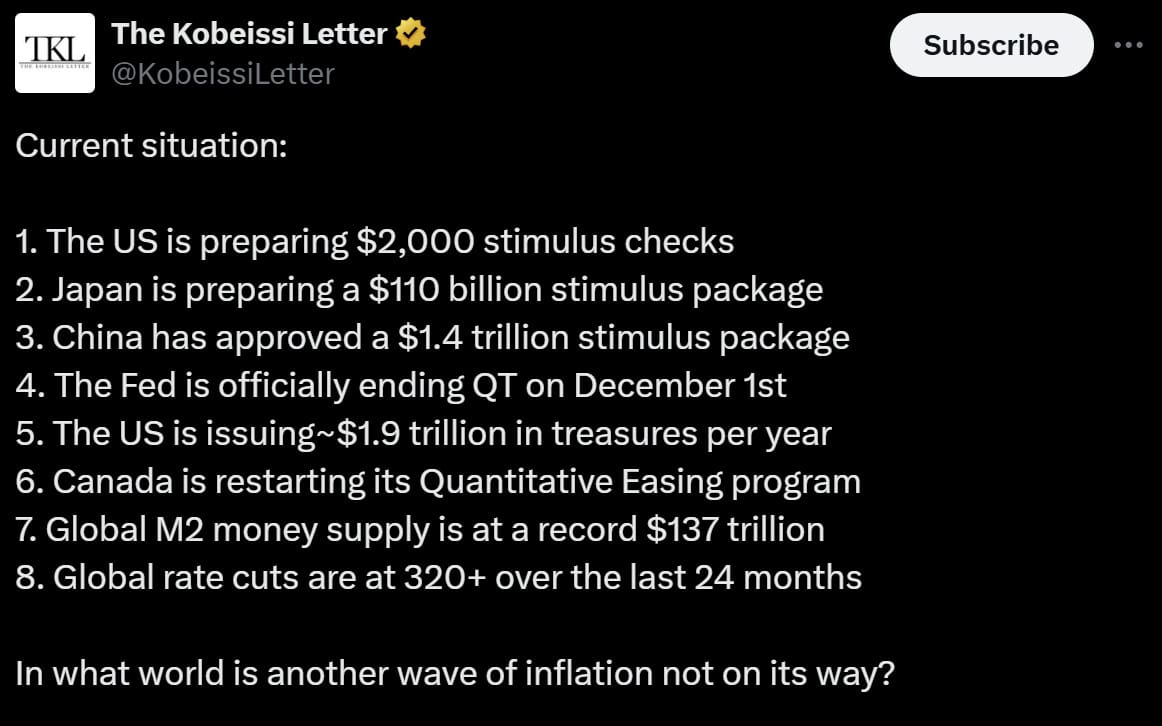

The tsunami of global liquidity coming soon is unlike anything the market has seen in years.

New liquidity = new highs.

This isn't crypto winter. This is the short-term bear pullback inside a bigger bull. We’ve still got a few months of chop and pain… but the destination hasn’t changed.

We’ll keep delivering the weekly hopium until we’re ripping face-melting green candles again.

Stay strapped. Stay alive.

Stay degen. 🚀💀🔥

UN-Limited Limit Orders

Why pay gas for limit orders that never execute? With CoW Swap, you can set an unlimited number of limit orders – more than your wallet balance – then cancel them all at no cost to you. Try Limit Orders.

Hodl Headlines

The Week’s Most Interesting News

U.S. Regulator Allows Banks to Hold Crypto-Assets: The Office of the Comptroller of the Currency has clarified that U.S. national banks may hold crypto-assets on their balance sheets when those assets are needed for paying blockchain network fees (“gas”), issuing a narrow but meaningful signal of regulatory accommodation.

Kraken Confidentially Files for U.S. IPO: Crypto exchange Kraken has filed a confidential S-1 with U.S. regulators signaling an IPO intended for Q1 2026, amid a wave of digital-asset companies racing to go public before regulatory and political uncertainty.

Czech Central Bank Buys $1 M in Bitcoin: The Czech National Bank has acquired roughly $1 million in Bitcoin and other digital assets as part of a pilot portfolio (held outside its main reserves) to test custody, operations and risk frameworks.

New Hampshire Launches First Bitcoin-Backed Municipal Bond: The state of New Hampshire has approved a ~$100 million municipal conduit bond backed by Bitcoin, marking a U.S. first in linking public-finance instruments to crypto collateral.

Bitcoin Core Audit Confirms Highly Mature Codebase: A recent independent security audit found the Bitcoin Core software to be “highly mature and well-tested,” uncovering no high or medium-severity vulnerabilities - solidifying confidence in Bitcoin’s foundational protocol.

White House Evaluates IRS Taxation of Foreign Crypto Holdings: The Internal Revenue Service, in consultation with the White House, is assessing tighter enforcement of tax reporting on foreign crypto-asset holdings, signaling increased scrutiny in cross-border digital-asset transparency.

Saylor Spends $835m on Bitcoin Purchase Amid Price Drop: Treasury-heavy firm Strategy Inc. acquired 8,178 BTC (~$835.6 million) at an average ~$102 K per coin between Nov 10-16 (just ahead of Bitcoin’s slide) underscoring the risks of timing large crypto-treasury moves.

Big thanks for making it to the end of this week’s Hodl Report! 👊

If you enjoyed the ride, had a good laugh or learned a thing or two, feel free to share the love! Just copy/paste this link over to anyone:

The more, the merrier - because who doesn’t love a bigger party? 🥳

Happy Friday!

Disclaimer: The content from Hodl Report should not be taken as trading, investment or financial advice or solicitation to buy or sell any assets. This newsletter is for informational and educational purposes only. Please be careful out there and DYOR (do your own research)